USDA Payments Provide Boost to Farmer Sentiment in January

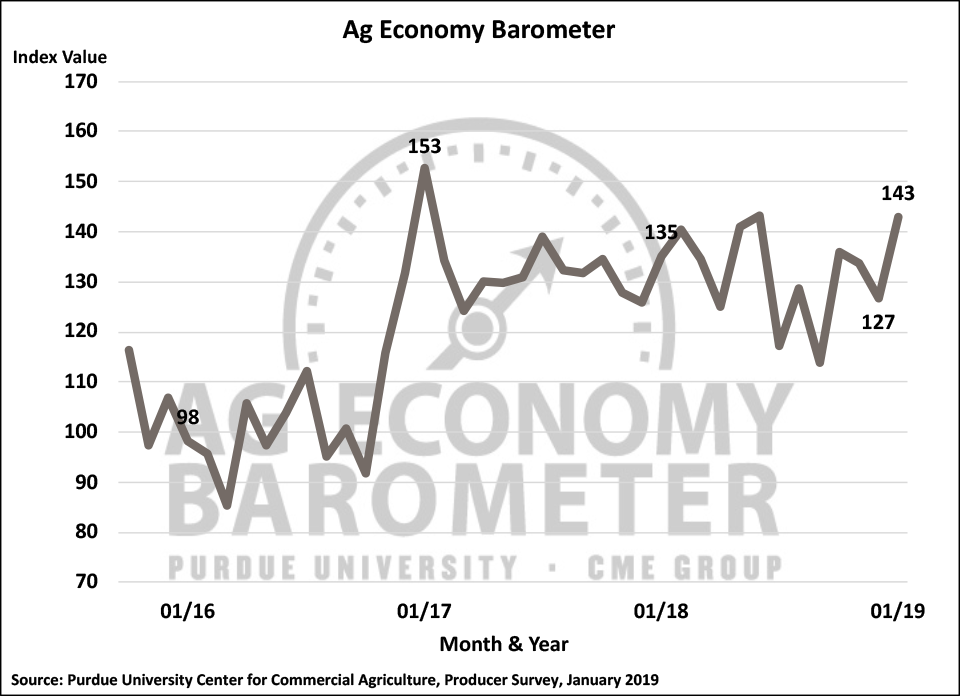

The Purdue University/CME Group Ag Economy Barometer rebounded sharply in January to a reading of 143, a 16-point improvement compared to December and the highest Barometer reading since June 2018. The January survey provided the first opportunity to measure farmer sentiment following USDA’s announcement that the second round of Market Facilitation Program(MFP) payments would be made to soybean producers and it was also the first survey taken following passage of the Agricultural Improvement Act of 2018 (2018 Farm Bill), both of which appear to have helped boost farmer sentiment. In particular, total MFP payments (first and second installments, combined) to U.S. soybean farmers were estimated by USDA to be about $7.3 billion, providing a significant revenue boost to most Corn Belt farming operations.

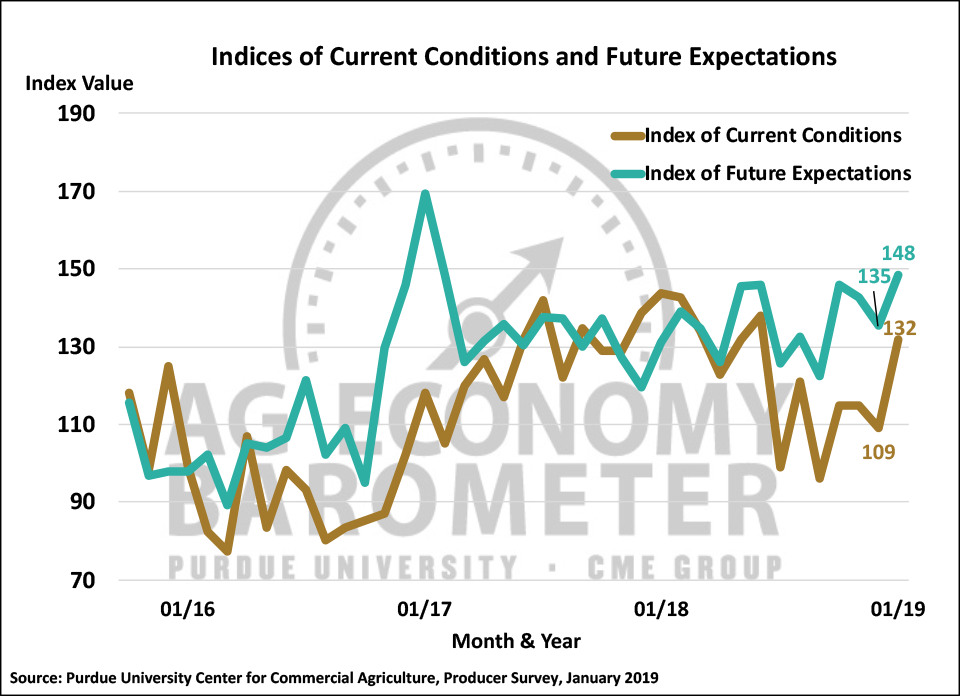

The jump in the barometer from December to January was driven by increases in both of the barometer’s sub-indices but the biggest improvement was in the Index of Current Conditions, which rose to a reading of 132 from 109 a month earlier. In comparison, the Index of Future Expectations rose to 148 in January, 13 points above its December reading of 135 and its highest value since February 2017. The rise in the Current Conditions Index took it back to just below its June 2018 level.

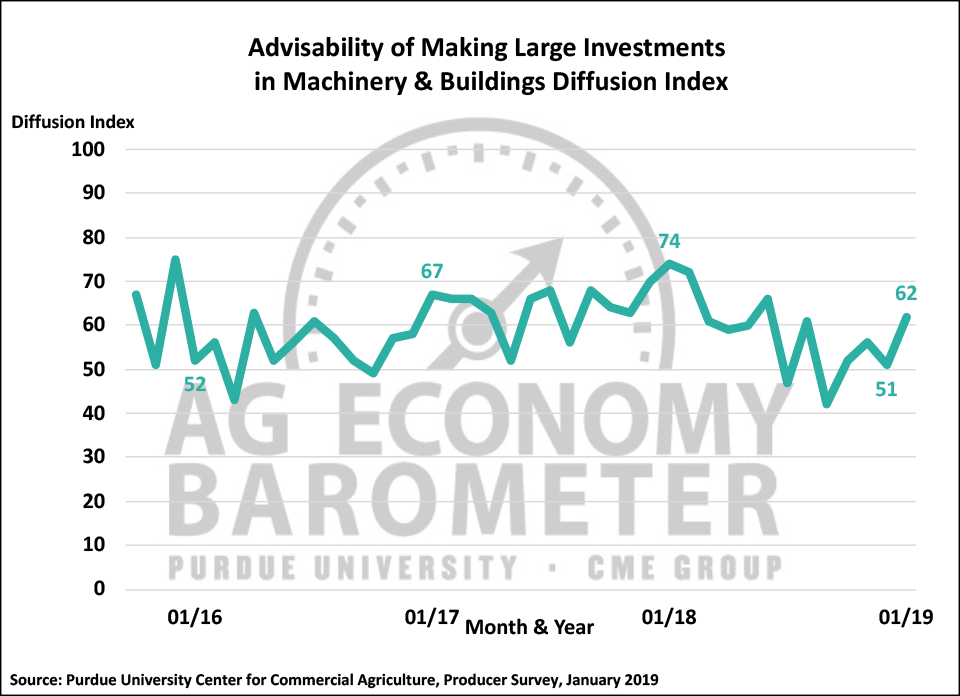

Producers indicated they were more inclined to view making large investments in their farming operations favorably on the January survey than they did a month earlier. The Large Farm Investment Index rose to 62 in January, 11 points above its December value and the highest reading for the investment index since last June. Although the index was still below a year earlier in January, it has increased substantially over the last several months. The index bottomed out at 42 in September and has risen every month since then, except December when a modest decline occurred.

Although producers held a more favorable view of making investments in machinery and buildings in January than in late 2018, that perspective did not seem to carry over into their view of farmland values. When asked for their expectations for farmland values in the upcoming 12 months, producers’ attitude actually weakened slightly compared to November 2018 (the last time farmland value questions were posed) as the percentage expecting higher values declined from 17 to 13 percent and the percentage expecting lower prices drifted down to 21 from 22 percent. Producers longer term view of farmland values also weakened compared to November as the percentage expecting higher values declined 2 points to 48 percent and the percentage expecting lower values rose 4 points to 13 percent.

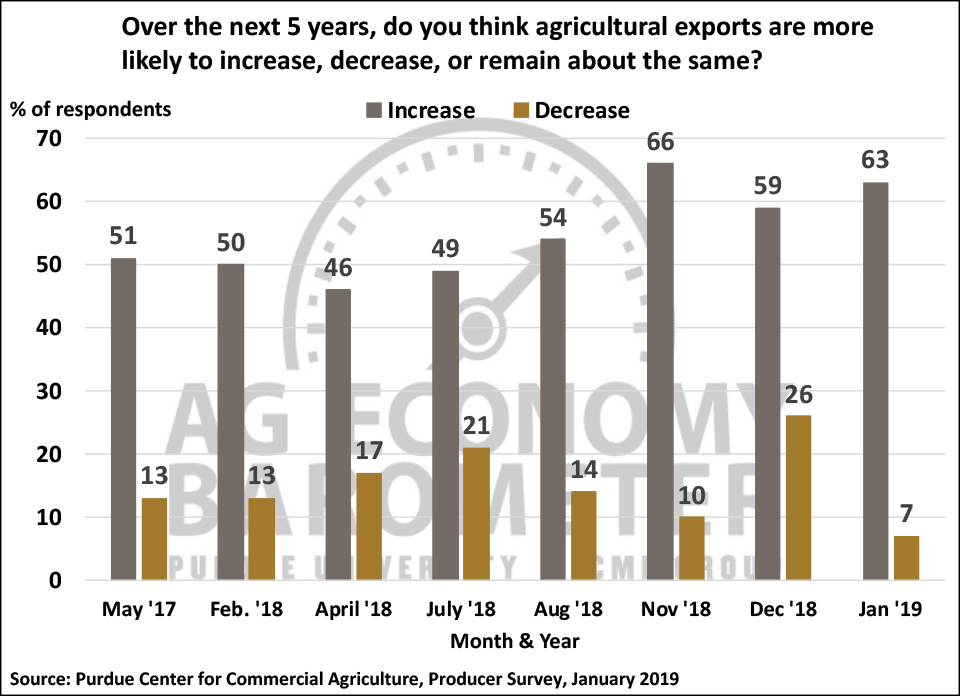

What’s going to happen with respect to trade negotiations continues to weigh heavily on U.S. farmers’ minds. In January, producers indicated that they were a bit more optimistic about the future for agricultural trade as 63 percent responded that they expect U.S. ag exports to increase over the next 5 years, compared to 59 percent in December. More significantly, the percentage of farmers expecting ag exports to decline over the next five years declined to just 7 percent, the lowest percentage since we first posed this question in May 2017, compared to 26 percent a month earlier.

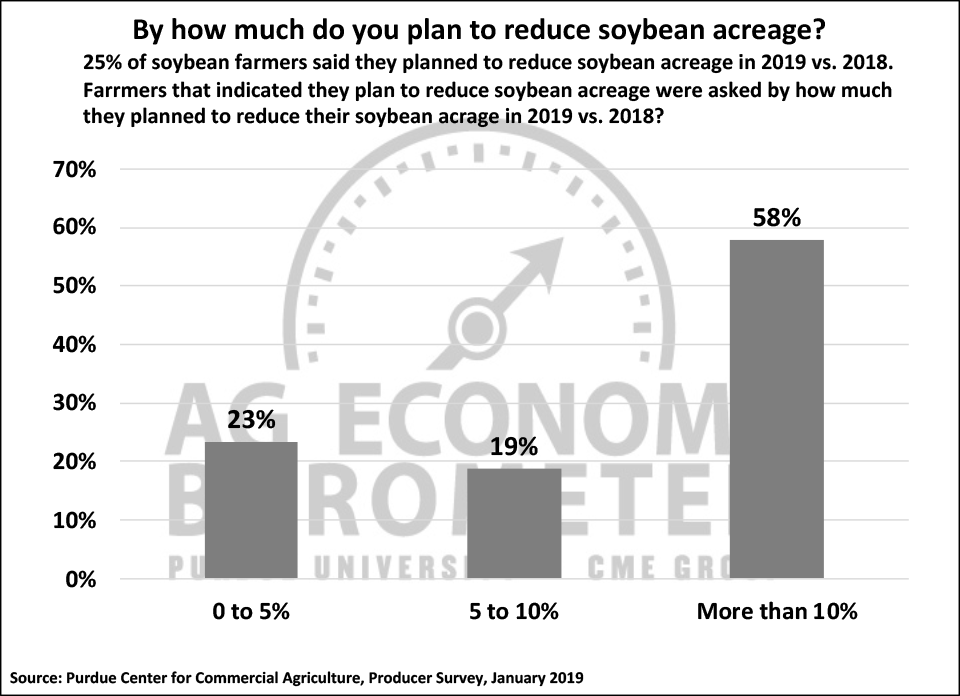

There continues to be a lot of uncertainty regarding a possible shift in acreage between corn and soybeans in 2019. We asked producers that planted soybeans in 2018 what their plans are for 2019. Twenty-five percent of respondents that planted soybeans last year said they plan to reduce their soybean acreage in 2019 while two-thirds (67%) expect no change in their soybean acreage. Among those soybean farmers that expect to reduce soybean acreage, 58 percent of them expect to reduce their soybean acreage by more than 10% whereas the remaining 42 percent expect their acreage decline to be 10% or less.

Looking ahead to the rest of 2019, producers indicated that 2019 is poised to be a challenging year for many farm operations. A majority of producers (57%) indicated they expect their farms’ operating expenses to increase this year with 38 percent expecting operating expenses to be about the same, both compared to 2018. When asked if they expect livestock and grain prices to increase to levels that will substantially improve their farm’s financial situation in the next year, 70 percent of respondents said no. More specifically, when asked about their soybean price expectations, four out of 10 respondents (43%) said they expect November 2019 soybean futures to fall below $8.50 sometime between mid-January and summer 2019. Looking at their farm’s financial situation, 25 percent of respondents said they expect to have a larger farm operating loan in 2019 than in 2018. Among those expecting to have a larger operating loan, over half (53%) said it was because input costs increased. However, just over one-fourth (27%) said it was because they were carrying over unpaid operating debt from prior years, suggesting that their farm operation is under financial stress.

Wrapping Up

Producer sentiment improved markedly in January compared to a month earlier. Producers view of current conditions and expectations for the future both improved, but the large improvement in farmers’ perspective on current conditions was the biggest driver behind the Ag Economy Barometer’s increase. The boost in revenue provided by USDA’s MFP payments and the passage of the 2018 Farm Bill, both of which took place in December but after the December survey was conducted, were likely responsible for some of the improvement in farmers’ sentiment. The sentiment improvement spilled over into a more optimistic perspective on making large investments in items like machinery and buildings as the Large Farm Investment Index rose 11 points in December to reach its highest level since last June. Although producers looked more favorably upon investing in machinery and buildings, that did not carry over into their views regarding future farmland values which weakened somewhat over both a 12-month and 5-year time horizon.

Looking ahead to plans for 2019, nearly one-fourth of farmers that planted soybeans in 2018 plan to reduce their soybean acreage this year whereas just 8 percent plan to increase their soybean acreage. Among those that plan to reduce acreage, 58 percent plan to reduce their acreage by 10 percent or more. This was a lower percentage than recorded on the November 2018 survey when 69 percent of growers planning to reduce soybean acreage said they expected to reduce soybean acreage by 10 percent or more.

Source: Purdue University