USDA Agricultural Trade Outlook-FY 2021 U.S. Agricultural Exports Forecast Up $5.5 Billion

On Wednesday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Bart Kenner and Hui Jiang.

The Outlook stated that, “U.S. agricultural exports in Fiscal Year (FY) 2021 are projected at $140.5 billion, up $5.5 billion from the revised forecast for FY 2020. This increase is primarily driven by higher exports of soybeans and corn.

Soybean exports are forecast up $4.2 billion from FY 2020 to $20.4 billion, largely due to expected strong demand from China and reduced competition from Brazil. Corn exports are projected up $700 million to $9.0 billion on expectations of higher export volume.

“For FY 2020, the export forecast of $135.0 billion represents a reduction of $1.5 billion from May’s projection, mainly due to a reduction in the forecast for horticultural, beef and veal, and soybean exports.”

The Outlook also noted that, “The forecasts in this report are based on policies in effect at the time of the August 12 World Agricultural Supply and Demand Estimates (WASDE) release and the U.S. production forecasts thereof.”

More narrowly, FAS-ERS explained that, “Fiscal year (FY) 2021 U.S. grain and feed exports are forecast at $31.0 billion, up $1.1 billion from 2020 on higher corn, sorghum, and rice exports, while wheat exports are forecast to decline. Corn exports are forecast at $9.0 billion in 2021, up $700 million on expectations of competitive prices and larger export volumes. Sorghum exports are forecast at $1.4 billion, up $400 million from the FY 2020 estimate amid large early sales and the strong pace of shipments to China…Wheat exports are forecast at $6.0 billion, down $200 million mainly on lower volumes; unit values are also projected down slightly. Russia’s second- largest wheat crop on record is likely to limit U.S. competitiveness in price-sensitive markets. The prospect of continued shipments to China is a bright spot for U.S. wheat trade, but exports to other Asian countries could be affected by large exportable supplies in Australia and Canada.”

Wednesday’s report indicated that, “FY 2020 U.S. grain and feed exports are forecast at $29.9 billion, up $500 million from the May forecast, as higher wheat and corn exports more than offset lower rice exports. Corn exports are forecast at $8.3 billion, up $300 million on higher unit values and slightly higher volume. Sorghum exports are forecast at $1.0 billion, unchanged from the previous quarter… Wheat exports are forecast at $6.2 billion, up $100 million on larger volume, which more than offsets marginally lower unit values. Large sales to Brazil and China have supported exports in recent months, but prices are not recovering due to pressure from abundant U.S. corn supplies.”

With respect to oilseeds, The Outlook stated that, “FY 2021 oilseed and oilseed product exports are forecast at $29.1 billion, up $3.7 billion from 2020 primarily on higher soybean volume.

Soybean export volume is forecast to rise nearly 30 percent year-over-year as growing demand in China and significantly reduced export volume forecast from Brazil opens the door for a substantial rise in U.S. exports. However, record U.S. soybean supplies are expected to push unit values lower. Total soybean export value is forecast at $20.4 billion, a $4.2 billion increase over FY 2020.

With respect to FY 2020, the report noted that, “The oilseeds and products FY 2020 forecast is revised down $100 million from the May forecast to $25.4 billion. Reduced soybean export value is partially offset by stronger soybean oil trade. A strong Brazil soybean export pace and weak currency added headwinds to U.S. sales over the past months.”

Wednesday’s report added that, “FY 2021 livestock, poultry, and dairy exports are forecast up $500 million from 2020 to $32.3 billion on growth in beef, poultry products, and dairy. Beef exports are up $200 million as higher volumes more than offset a decline in unit values. Pork exports are forecast unchanged at $7.0 billion on stable volumes and lower unit values.

Exports to China are expected to slow owing to ongoing hog herd rebuilding, while demand from other key markets may be constrained by weak economic growth.

“Poultry and poultry products are forecast $100 million higher to $5.1 billion on minor adjustments to poultry products. Dairy product exports are up $100 million to $6.6 billion due to stronger global import demand and increasing competitiveness of U.S. dairy products on global markets.”

And The Outlook pointed out that, “The FY 2020 livestock, poultry, and dairy export forecast is lowered $600 million to $31.8 billion as declines in beef and poultry more than offset gains by pork, dairy, and hides and skins. The beef export forecast is revised down $500 million on lower volumes and lower prices. Pork export forecasts are up $100 million from the May estimate on higher volume. The poultry and poultry product export forecast is reduced $500 million to $5.0 billion on lower prices for broiler and turkey meat. The dairy product export forecast is raised $300 million due to higher volumes of skimmed milk powder, whey, and cheese.”

With respect to regional trade, FAS-ERS stated that,

The export forecast for China is $18.5 billion, $4.5 billion higher than the revised FY 2020 estimate. Demand for soybeans is expected to grow while Brazilian supplies are forecast to decline, boosting U.S. soybean export prospects. Continued strong demand for corn, sorghum, and tree nuts also contributes to the higher forecast.

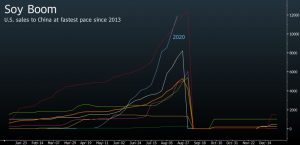

Meanwhile, Bloomberg News reported on Wednesday that, “China is set to buy a record amount of American soybeans this year as lower prices help the Asian nation boost purchases pledged under the phase-one trade deal, according to people familiar with the matter. Soy futures in Chicago climbed to a seven-month high.

“The total from the U.S. will probably reach about 40 million tons in 2020, the people said, asking not to be identified because the forecast isn’t public. That would be around 25% more than in 2017, the baseline year for the trade deal, and roughly 10% more than the record set in 2016, according to data from the U.S. Department of Agriculture.”

The Bloomberg article added that, “China has been stepping up purchases of American agricultural goods since the end of April, with soybean sales for delivery next season currently running at their highest level for this time of year since 2013. The Asian nation has also set several daily records in corn purchases, putting it on track to exceed for the first time an annual quota set by the World Trade Organization.”

“The U.S. and China reaffirmed their commitment to the phase-one accord in a biannual review this week, showing a willingness to cooperate on trade even as tensions escalate over issues ranging from data security to the future of democracy in Hong Kong,” the Bloomberg article said.

Source: Keith Good, Farm Policy News