U.S., China Sign Phase One Trade Deal-Agricultural Purchases Included

Financial Times writer James Politi reported on Wednesday that, “The US and China have signed an agreement to pause the trade war that has weighed on the global economy for nearly two years, while leaving in place tariffs on hundreds of billions of dollars of Chinese imports.

“The so-called phase one deal signed at the White House on Wednesday offers some relief following the anxiety in global markets and uncertainty for business that marked the lengthy period of economic conflict between Washington and Beijing.

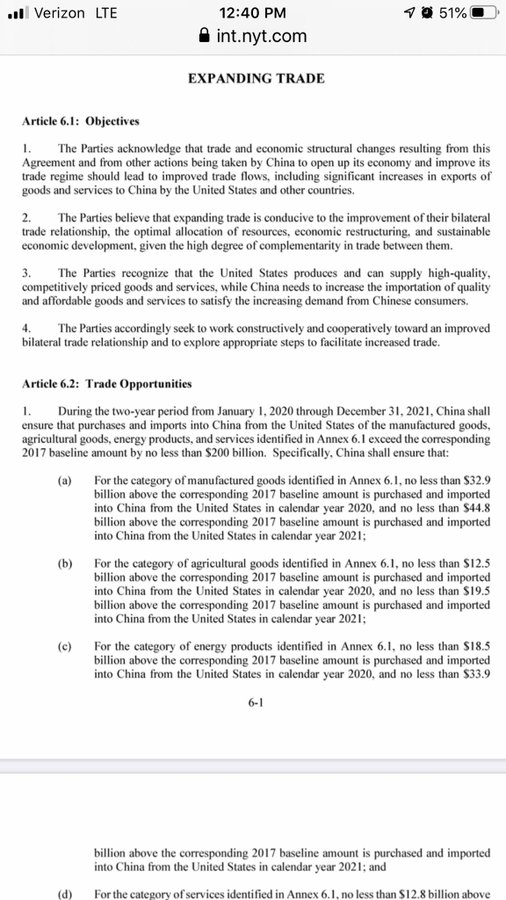

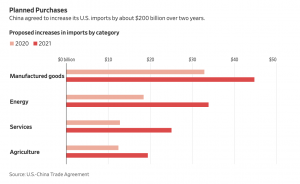

“The 86-page English-language text contains eight chapters, ranging from stricter rules on intellectual property in China to a pledge by Beijing to purchase at least $200bn in US goods and services over the next two years, as well as a commitment by China not to manipulate its currency.”

FULL DOCUMENT: The US-China “Phase 1” trade deal signed today at the White House (94 pages) | #OOTT #TradeDeal #OATT Link: https://assets.bwbx.io/documents/users/iqjWHBFdfxIU/rVaHxDBUtdew/v0 …

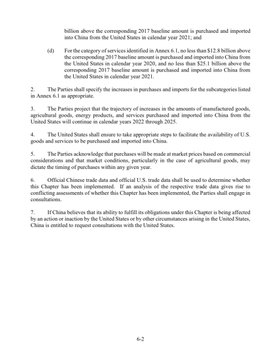

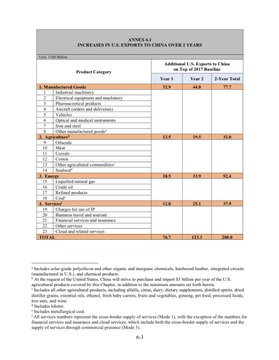

And here the key pages of the document laying out the Chinese commitments to buy extra US agricultural and energy commodities | #OOTT #oil #LNG #coal #OATT #soybean #corn #beef #pork

The FT article pointed out that, “The deal leaves the vast bulk of US tariffs on $360bn of Chinese goods in place while avoiding the threat of further escalation for now. However, the agreement does contain an enforcement mechanism by which the US could revive its tariff threat if China is seen as violating its commitments.”

Scott Irwin@ScottIrwinUI · 21h

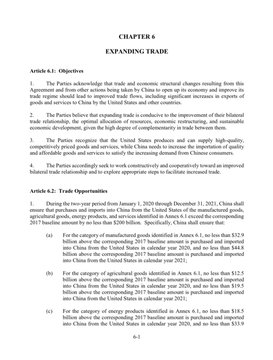

Phase 1 language in Ag purchases is more “contractual” than I expected

Note the commitments in chapter 6:

+ $12.5 billion over 2017 levels in 2020

+ $19.5 billion over 2017 levels in 2021

Less than the earlier reports that we would see$20-$30 billion more each year. Also, this seems to be just a two year agreement.

Note the commitments in chapter 6:

+ $12.5 billion over 2017 levels in 2020

+ $19.5 billion over 2017 levels in 2021

Less than the earlier reports that we would see$20-$30 billion more each year. Also, this seems to be just a two year agreement.

Mr. Politi added that, “Although discussions about the next phase of talks are expected to begin after the phase-one deal takes effect in mid-February, there is no set timeline for their conclusion. It is unclear whether a second agreement will be reached before the US presidential election in November.”

Wall Street Journal writers Bob Davis and Lingling Wei reported on Wednesday that, “The biggest section of the deal covers Chinese purchases. Beijing pledged to buy an additional $200 billion in goods and services over the next two years in manufactured goods, agriculture, energy and services. The deal gave dollar amounts for broad categories of exports, but didn’t provide any detailed purchasing plans.”

Highlight: U.S. Secretary of Agriculture @SecretarySonny

on the enforcement mechanisms in the trade deal: “This is one of the unique aspects of this trade relationship that we’ve never seen before. It essentially has unilateral trade enforcement priorities for the United States.”

DTN Ag Policy Editor Chris Clayton reported on Wednesday that, “Under the deal, agricultural sales to China could reach $50 billion a year, the president said. Still, Trump’s team stated China agreed to $40 billion in ag purchases for each of the next two years. Trump said the initial talks called for $20 billion in ag sales, but he demanded that be more than doubled, even though his trade negotiators did not think farmers could meet that demand volume.

‘I said ‘I love our farmers. Let them tell me they can’t do it.’ I said. ‘Tell them to go out and buy a larger tractor. Buy a little more land.’ But I have no doubt they will be able to do it,’ Trump said at the signing ceremony.

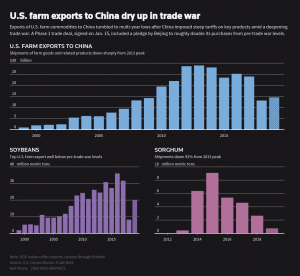

“Agricultural exports to China reached $23.8 billion in 2017, making it the largest U.S. export market, especially for soybeans. Sales fell to $9.3 billion overall in 2018 as the trade dispute heated up. Ag sales picked up in 2019, but official totals for last year have not been released.”

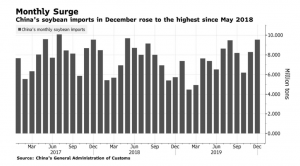

More narrowly with respect Chinese agricultural imports, Bloomberg writer Alfred Cang reported on Monday that, “Chinese pork imports jumped 75% to a record in 2019 as the government sought to curb prices after African swine fever ravaged herds.”

The Bloomberg article added that, “Imports of U.S. pork and soybeans increased notably in December in the runup to a phase-one trade deal between the two nations, according to customs.”

However, Reuters writers Hallie Gu and Tom Westbrook reported on Tuesday that, “Commodity traders and analysts are struggling to map out how China will reach the eye-popping amounts it is committing to buy from the United States under Phase 1 of their trade deal.”

.@FoxBusiness Video: #China will buy twice as much #agriculture as ever before: @SecretarySonny.https://video.foxbusiness.com/v/6122894472001/#sp=show-clips …

FOX Business @FoxBusiness

Bloomberg writer Michael Hirtzer reported on Wednesday that, “In an agreement signed Wednesday at the White House, China committed to importing at least $12.5 billion more agricultural goods this year than in 2017, rising to $19.5 billion next year. China will also ‘strive‘ to purchase an additional $5 billion a year in farm products. That could get total purchases next year toward the $50 billion mark.

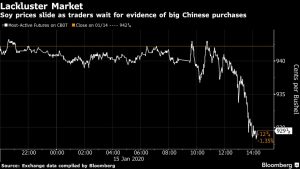

“But doubts have surfaced on whether China will meet that target, particularly since the two governments have said they will keep secret the purchase benchmarks for individual commodities. The market is already looking for real evidence that China will follow through on its pledges of more purchases, and in big amounts. It will take time for such evidence to emerge.”

Scott Irwin@ScottIrwinUI · 20h

I find the complete lack of bullish reaction quite interesting. This says market thinks it has already fully priced in what is going to happen. And market is very skeptical about what will happen https://twitter.com/FarmPolicy/status/1217534694314725376 …

Yes, and it doesn’t build much confidence when VP Liu says that China’s agricultural purchases will be driven by demand and will rise “if the demand” is there (from Bloomberg Terms of Trade @economics

And Reuters writers Karl Plume and Tom Polansek reported on Wednesday that, “China’s pledge to buy U.S. farm goods based on ‘market conditions’ during the Phase 1 trade deal signing ceremony on Wednesday added to doubts among farmers and commodity traders over Beijing’s lingering tariffs on U.S. exports.”

The Reuters article pointed out that, “Chinese Vice Premier Liu He, standing beside Trump, said on Wednesday that Chinese firms will buy American products ‘based on market conditions.’”

Plume and Polansek added that, “Following the comment, the price of soybeans, the top U.S. farm product shipped to China by value before the trade war, fell to a one-month low on the Chicago Board of Trade futures market SH0.”

Source: Keith Good, Farm Policy News