Trade Tensions Simmer; China Purchases U.S. Farm Goods as African Swine Fever Impacts Pork Market

On Thursday, Wall Street Journal writers Lingling Wei, Chao Deng and Josh Zumbrun reported that, “China is looking to narrow the scope of its negotiations with the U.S. to only trade matters, seeking to put thornier national-security issues on a separate track in a bid to break deadlocked talks with the U.S.”

The Journal writers explained that,

Thursday’s move is the latest in a series of steps officials in Washington and Beijing are taking to ease trade tensions ahead of high-level negotiations in October.

“It followed President Trump’s move on Wednesday to postpone until Oct. 15 a tariff increase on roughly $250 billion in imports that had been set to hit on Oct. 1, in what he called a goodwill gesture as China marks the 70th anniversary of Communist rule on that date.

At the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their 70th Anniversary….

Donald J. Trump✔@realDonaldTrump

….on October 1st, we have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th.

“Chinese negotiators, meanwhile, are making plans to boost purchases of U.S. agricultural products, give American companies greater access to China’s market and bolster intellectual-property protections, people familiar with their plans said. China also this week announced a series of exemptions to its tariffs on U.S. imports.”

Also Thursday, Reuters writer Karl Plume reported that, “Privately run Chinese firms bought at least 10 boatloads of U.S. soybeans on Thursday, the country’s most significant purchases since at least June, traders said, ahead of high-level talks next month aimed at ending a bilateral trade war that has lasted more than a year.

“The soybean purchases, which at more than 600,000 tonnes were the largest by Chinese private importers in more than a year, are slated for shipment from U.S. Pacific Northwest export terminals from October to December, two traders with knowledge of the deals said.”

Donald J. Trump✔@realDonaldTrump

It is expected that China will be buying large amounts of our agricultural products!

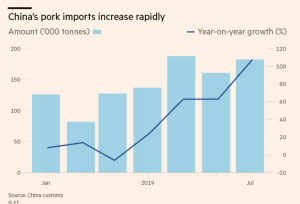

Mr. Plume added that, “Also on Thursday, the U.S. Department of Agriculture (USDA) reported China bought 10,878 tonnes of U.S. pork in the week ended September 5, the most in a single week since May.”

Foreign Ag Service✔@USDAForeignAg

Private exporters reported to @USDA #export sales of 204,000 MT of #soybeans for delivery to #China during MY 2019/2020. http://ow.ly/NoOB50w8oon

Foreign Ag Service✔@USDAForeignAg

Private exporters report sales of 256,000 MT of #soybeans for delivery to China during MY 2019/2020. http://ow.ly/qOkf50wboHV

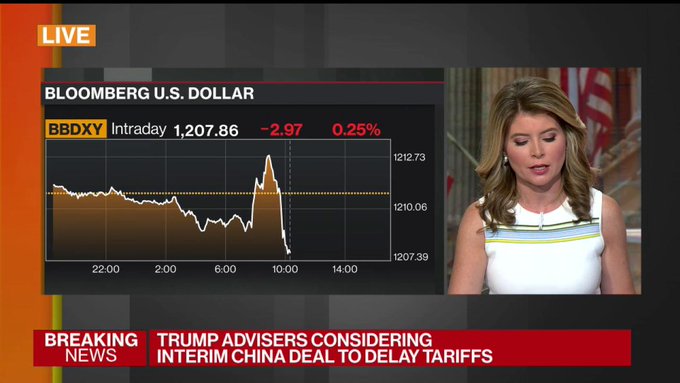

Meanwhile, Bloomberg writer Josh Wingrove reported on Thursday that, “President Donald Trump said he would be open to an interim trade deal with China but would prefer a lasting deal.”

The Bloomberg article pointed out that, “Trump administration officials have discussed offering a limited trade agreement to China that would delay and even roll back some U.S. tariffs for the first time in exchange for Chinese commitments on intellectual property and agricultural purchases, according to five people familiar with the matter.”

Trump advisers are considering an interim deal with China to delay tariffs. @sdonnan breaks it down https://bloom.bg/2URyxTq

Then on Friday, Tom Hancock and James Politi reported at The Financial Times Online that, “China said it would cancel additional tariffs on imports of soyabeans and pork that it intends to purchase from the US, in the latest of a series of goodwill gestures aimed at de-escalating a trade war between the world’s two largest economies.

The operative word is “additional” tariffs–i.e., the additional 5% China imposed on Sep 1. Still means the 25% surcharge is on the books. Lets get back to 3% and let commercials (not COFCO or Sinograin) decide when to import. https://twitter.com/New10_AgEcon/status/1172536323791605760 …

“China has encouraged companies to buy ‘a certain quantity’ of pork and soyabeans from the US and they will be exempted from additional tariffs, state-run broadcaster CCTV reported, apparently referring to duties imposed since the start of the trade war.”

China said it is encouraging companies to buy U.S. farm products including soybeans and pork as trade tensions thaw https://bloom.bg/2lU6a9m

The FT writers explained that, “Beijing’s pledge to purchase unspecified amounts of both products from the US at the same tariff rates it applies to other WTO members came hours after US President Donald Trump said he would consider doing an ‘interim deal’ with China.

People briefed on the matter said the idea being discussed within the Trump administration was to return to the status quo earlier this year, when tariffs were in place on $250bn of Chinese exports.

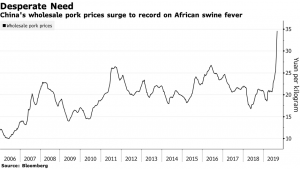

New York Times writer Alexandra Stevenson provided additional perspective on this development Friday, pointing out that, “The easing of agricultural tariffs could also help China with its own problems. Food inflation has been rising as the Chinese authorities battle an epidemic of swine fever, which has forced China to cull more than a million pigs. Pork is a staple of the Chinese diet.”

“China May Import More U.S. Pork to Fight Soaring Pork Prices,” Bloomberg News (September 12, 2019).

“Europe and Brazil help fill China’s 10m-tonne pork shortfall– Imports surge after African swine fever cull reduces pig stocks by a third,” by Tom Hancock, Wang Xueqiao, Emiko Terazono and Andres Schipani. The Financial Times (September 9, 2019).

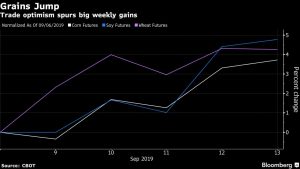

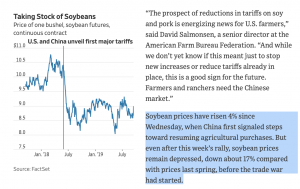

With respect to the market impact of some of these trade developments, Bloomberg writer Michael Hirtzer reported on Friday that, “There’s been plenty of back and forth in the U.S.-China trade war. But for the first time in months, crop markets have started to show some optimism that the two sides can reach a deal, giving American farmers some hope.”

“U.S. Crop Markets Finally Give Farmers Hope for Deal With China,” by Michael Hirtzer. Bloomberg News (September 13, 2019).

“Soybean futures closed the week up more than 4%, the biggest gain for the November contract since May. October hogs surged 10%, the most since April, and cotton had its best week since June 2018,” the Bloomberg article said.

“China to Exempt U.S. Soybeans, Pork From Punitive Tariffs,” by Chao Deng, Lucy Craymer and Josh Zumbrun. The Wall Street Journal (September 13, 2019).

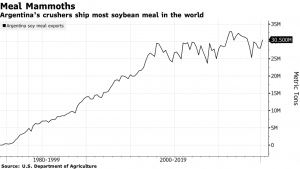

Additional trade news regarding soy, China and Argentina also emerged last week.

Reuters writers Hugh Bronstein and Maximilian Heath reported last week that,

China will allow the import of soymeal livestock feed from Argentina for the first time under a deal announced by Buenos Aires on Tuesday, an agreement that will link the world’s top exporter of the feed with the top global consumer.

The Reuters article explained that, “Argentina had tried for years to break into the Chinese market, the biggest consumer of the meal it uses to feed its massive hog herd. China, with its own crushing industry to protect, had steadfastly resisted.

“The U.S.-China trade war, however, strengthened Argentina’s hand, prompting China to expand its soymeal import options, market sources say.”

“China Seeks Argentine Soy Meal in Fresh Blow to U.S. Farmers,” by Jonathan Gilbert. Bloomberg News (September 10, 2019).

Jonathan Gilbert noted last week at Bloomberg that, “Beijing has been loathe to accept Argentine meal because it prefers to import raw soybeans and process them in China to promote its own crushing industry. But the trade war has been turning global supply chains on their head.”

In other developments, Washington Post writer Jeff Stein reported last week that, “Senior government officials, including some in the White House, privately expressed concern that the Trump administration’s nearly $30 billion bailout for farmers needed stronger legal backing, according to multiple people who participated in the planning.”

And on Saturday, Washington Post writers Jeff Stein and Mike DeBonis reported that, “House Appropriations Committee Chair Nita Lowey (D-N.Y.) is proposing to block the White House request over its farm bailout program, according to a draft of legislation reviewed by the Washington Post, potentially imperiling President Trump’s ability to direct payments to thousands of farmers.”

Source: Keith Good, Farm Policy News