Soybean Prevent Planting Decisions in Middle June, Cover Crops, and MFP Payments

Farmers across the Midwest can now take prevent planting payments on soybeans, as final planting dates for crop insurance purposes have arrived. Our comparisons suggest that planting soybeans do not have higher returns than taking a prevent planting payment given a high coverage level on crop insurance. However, the risk for lower returns from planting as compared to taking the prevent planting payment is limited as crop insurance provides a floor on revenue. These risks become greater the later soybeans are planted in the late planting period. The economic advisability of planting soybeans depends on receiving Market Facilitation Payments and no additional Federal aid for prevent planting acres. Our current projections indicate that returns from either prevent planting or planting soybeans will not cover costs and working capital will be eroded. At the end of this article, links to YouTube videos provide the latest information on cover crops and the Market Facilitation Program as well as a general background on preventing planting.

Yield Declines and Soybean Prevent Plant Decisions in 2019

Final planting dates for soybeans have passed in all the Corn Belt (see farmdoc daily, May 7, 2019). For Illinois, the final planting date is June 15 for northern Illinois counties and June 20 for central and southern Illinois counties. After reaching the final planting date, farmers can take soybean preventing plant payments on farmland that was intended to be planted to soybeans if they had purchased a COMBO crop insurance plan (Revenue Protection (RP), RP with harvest price exclusion, and Yield Protection). Farmers can continue to plant soybeans, however, the crop insurance guarantee goes down 1 percent per day for each day after the final planting date during the late period. In Midwest states, the late planting period lasts 25 days after the final planting date. After the late planting period, soybeans can still be planted, but the guarantee is 60% of the original revenue guarantee.

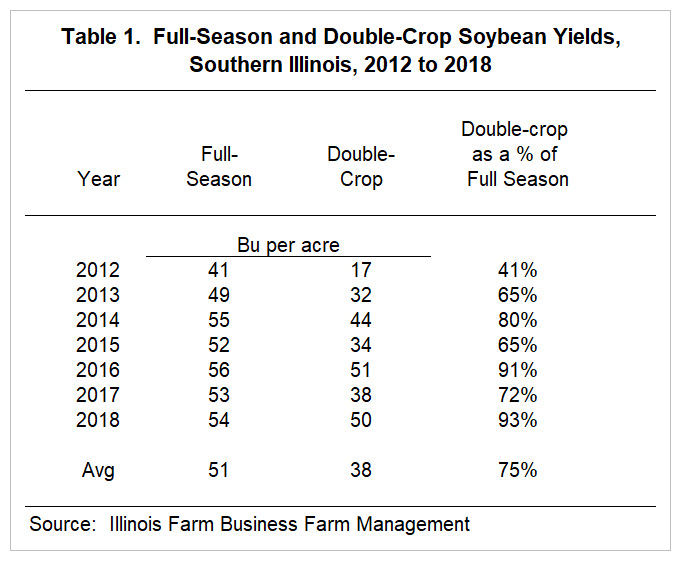

A key to evaluating the plant versus prevent plant decision is assessing yield losses from late planting. A comparison of double-crop soybean yields to full-season soybean yields in southern Illinois provides some indications of yield declines with late planting. Yield data were obtained from Illinois Farm Business Farm Management (FBFM). From 2012 to 2019, double-crop soybean yields averaged 38 bushels per acre, 75% of the average full-season yield of 51 bushels per acre (see Table 1).

In a recent farmdoc daily article (June 6, 2019), soybeans planted on June 20th were estimated to have an expected yield equal to 72% of the maximum economic yield. The 72% estimate from this article is close to the above 75% average of the double-crop yields compared to full-season yields. Given this comparability, late-season planting will be assumed to yield 70% of the typical yield. Of course, as shown in Table 1, wide variation exists, with double-crop soybean yield ranging from 41% (2012) and 65% (2013; 2015) to 91% (2016) and 93% (2018). Given the poor, wet conditions that many soybeans are being planted in, a lower expected yield may be warranted.

Comparison of Prevent Plant and Planting

Prevent planting versus planting is compared for a specific situation: a farm with a 50 bushel Trend-Adjusted Actual Production History (TA-APH) yield who purchases an RP policy with an 80% coverage level. These parameters are close to norms in areas where prevent planting likely will be prevalent. The 2019 projected price for soybeans is $9.54 per bushel and soybeans have a prevent planting payment factor of .60. Actual calculations of prevent plant returns and planting returns are given below. For an individual making a decision on a specific farm, the Prevent Plant Calculator, a module within the Planting Decision Model, can facilitate making the calculations. The Planting Decision Model is a Microsoft Excel spreadsheet available for download from the FAST section of farmdoc (click here for download).

Net Returns from Prevent Planting: The prevent planting payment for this situation is:

$229 per acre = .60 payment factor x .80 coverage level x 50 yield x $9.54 price

Weed control and crop insurance premium will be incurred under prevent planting. A reasonable estimate of these costs is $40 per acre. This gives net returns from prevent planting of:

$189 per acre = $229 prevent plant payment – $40 costs

Net Returns from Planting Soybeans: In calculating net returns from planting, we will use a yield of 35 bushel per acre, which is 70% of the 50 TA-APH yield. Currently, the November Chicago Mercantile Exchange (CME) contract is trading near $9.40 per bushel. This $9.40 will be used as the estimate for harvest price used in calculating crop insurance payments. To account for basis, the cash price will be $.40 less than the harvest price, or $9.00 per bushel.

Under this price-yield scenario, revenue will come from three sources. First, crop revenue will equal:

$315 per acre = 35 bushels per acre x $9.00 cash price

Second, a 35 bushel per acre yield and $9.40 harvest price will generate a crop insurance payment. During the late planting period, the crop insurance guarantee declines each day, so knowing the date of planting is important. For this example, planting will occur one day after the final planting date, resulting in a 1% reduction in the guarantee. The original guarantee is

$382 per acre = .80 coverage level x 50 TA-APH x $9.54 projected price.

The 1 percent guarantee reduction results in a crop insurance guarantee of

$378 per acre = $382 original guarantee x (1 – .01 reduction).

For crop insurance purposes, harvest revenue is $329 per acre (35 yield x $9.40 harvest price), resulting in crop insurance payment of:

$49 per acre = $378 guarantee – $329 revenue.

Note that crop insurance proceeds will be important in revenue in all of our planting comparisons.

Third, there also will be an MFP payment this year. As of yet, the MFP payment is not known. We will use an estimate of $50 per acre. Given the above estimates, revenue is estimated at:

$414 per acre = $315 crop revenue + $49 crop insurance + $50 MFP.

Planting will incur costs which are assumed at $260 per acre. This $260 includes crop costs, crop insurance premium, and fieldwork costs. Seed costs are in the $260 total. If seed is treated and the seed cannot be returned, then those seed costs should not be included in the $260 total as this is a “partial” analysis. Overhead and land cost are not included as those will not vary between the prevent plant and plant alternatives. Given these costs, the net return from planting is:

$154 per acre = $414 revenue – $260 costs.

Note that the $154 is not net income. Net income will be much lower as land and overhead costs must be subtracted. The $154 per acre will result in negative net incomes, and serious erosions of working capital on most farms.

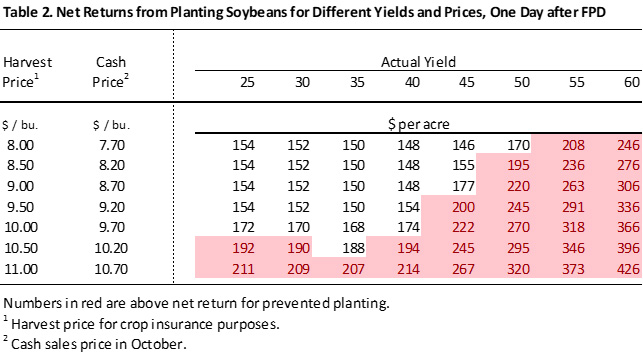

Comparing the alternatives: The $154 per acre is -$35 lower than the $189 net return from the prevent planting payment, suggesting that taking the prevent planting payment will have a higher return. Obviously, alternative yields and prices will result in different payments. Table 2 is a report from the Prevent Planting Calculator showering net returns from planting for different prices and yields.

At a 50 bushel harvested yield — equal to the TA-APH — harvest price must be over $8.50 for planting to have higher returns than prevent planting. At a 35 bushel yield — equal to 70% of the TA-APH yield — harvest prices must be over $10.50 for planting to have higher returns than taking the prevent planting payment.

Note that there is a floor under revenue at roughly $150 to $155 per acre (see Table 1). This occurs because many scenarios are generating crop insurance payments that counter crop revenue declines. The $150 to $155 ranges is about $35 less than prevent planting returns, suggesting that the downside for planting soybeans is at most $35 per acre for this example. Upside, however, also, is limited. An $11 harvest price and 35 bushel yield generates $212 per acre, only $23 higher than the prevent planting return (see Table 2).

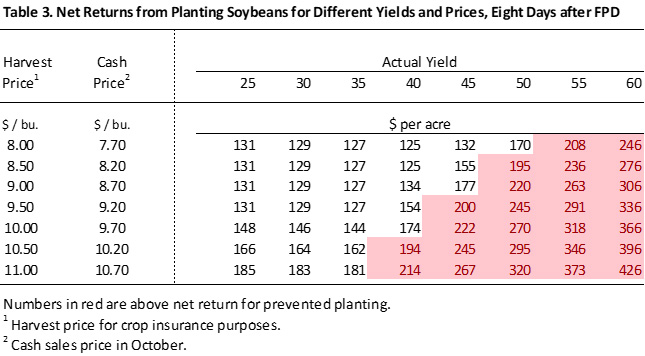

The floor on returns decreases with later planting as the crop insurance guarantee continues to decline. Table 3 shows the net returns table when planting eight days after the final planting date. Now the floor under revenue is at about $125 to $130 per acre, about $25 lower than on one day after the final planting date.

The advisability of planting depends critically on the $50 per acre MFP payment. Without the MFP payment, this analysis would suggest much more strongly not planting soybeans. The level of the MFP payment is not known. MFP payments will be paid in three tranches – early August 2019, November 2019, and January 2019 – and only the first payment is assured. Moreover, additional aid may be forthcoming for prevent planting acres through a recently passed ad hoc disaster assistance package. If additional aid is forthcoming for only prevent planting acres, the advisability of planting declines. Of course, the MFP payment level and payments from the ad hoc disaster assistance are not known now, and likely will not be known while prevent plant decisions are being made.

Lower coverage levels do not change the above analysis much because both prevent planting payment and crop insurance payments decline by approximately the same amount. Downside risks will still exist. The upside of planting is higher with lower coverage levels. Information like those in Table 2 and 3 can easily be produced with the Prevent Planting Calculator for different coverage levels.

Summary of Soybean Prevent Planting Decisions

When a prevent planting payment is available, planting soybeans is not generally shown to be more profitable, even early in the late insurance planting period, unless yields close to the TA-APH can be obtained or cash prices at harvest are above $10 at harvest, which the market is not currently offering. As planting moves later into June and July, harvested yields and harvest prices have to be even higher to make planting more attractive option than prevent plant. Harvested yields and prices are pushed even higher if MFP payments are lower than used in the example or only a portion of the payment is made.

These decisions will be difficult. The return from prevent planting will not come close to covering land and overhead costs that exist on most farms. As a result, taking a prevent planting payment will assure a loss on most farms, but will allow the farmer to know the lowest level of those losses. In both the prevent plant or plant alternatives, our estimates would suggest that losses will occur this year.

A YouTube video covering soybean prevent plant decisions is available at:

Cover Crops, MFP Payments, and Other Items

Planting cover crops on prevent planting acres is allowed. In general, planting a cover crop will not influence the size of prevent planting payments for those individuals who do not plan on haying, grazing, or harvesting the cover crop. Haying, grazing, and harvesting can reduce or eliminate the prevent plant payment if done prior to the permitted date per crop insurance terms. For this year only, the Risk Management Agency allows cover crops to by hayed, grazed, baled, or made into silage once September 1 is reached. The normal date is November 1. This information was received after the following YouTube video was made. These issues, along with linkages to the Market Facilitation Program, are covered in the following YouTube video:

The Market Facilitation Program (MFP) will occur in 2019. This program will make payments on acres planted to MFP-eligibility crops, with a limit of 2019 payment acres equal to 2018 plantings. A single per acre payment rate for each county will exist in 2019. What information is known about MFP is summarized in this video:

In case you want general background on prevent planting payments, check out this video:

Also, a video comparing the economics of planting corn versus taking a prevent plant payment has been developed. While it is highly likely that planting corn is unadvisable, this video provides the framework for evaluating those decisions:

References

Irwin, S. and T. Hubbs. “Late Planting and Projections of the 2019 U.S. Soybean Yield.” farmdoc daily (9):104, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2019.

Schnitkey, G. and C. Zulauf. “Late Planting Decisions in 2019.” farmdoc daily (9):83, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 7, 2019.

Source: Gary Schnitkey, Krista Swanson, Ryan Batts, Jonathan Coppess and Carl Zulauf, Farmdocdaily