Planting Troubles Worsen, Progress Lowest on Record for Corn

Unrelenting rainfall continues to cause headaches for Corn Belt farmers. Record-breaking precipitation this year has lead to flooding and historic delays in the pace of U.S. corn planting. Soybean planting has also fallen significantly behind the five year average. Today’s update recaps recent news articles and government reports that discuss these issues in more detail.

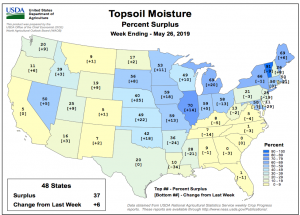

Weather- Excess Precipitation, Flooding

USA Today writer Doyle Rice reported on Wednesday that, “Flooding in at least 8 states along portions of the Mississippi River – due to relentless, record-breaking spring rainfall – is the longest-lasting since the ‘Great Flood’ of 1927, the National Weather Service said.”

Weekly Weather and Crop Bulletin- Volume 106, No. 22. USDA- Office of the Chief Economist (May 29, 2019).

Mr. Rice explained that, “The Mississippi River at the Quad Cities of Iowa and Illinois saw its longest stretch above major flood stage ever recorded, even surpassing that of 1927.”

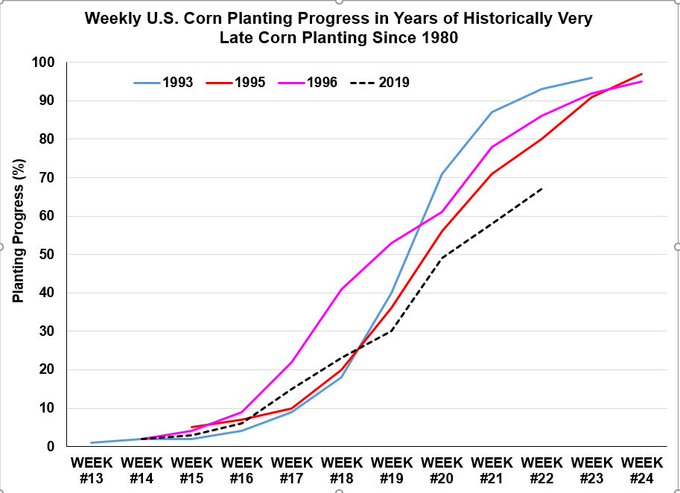

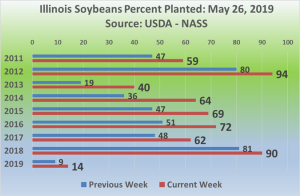

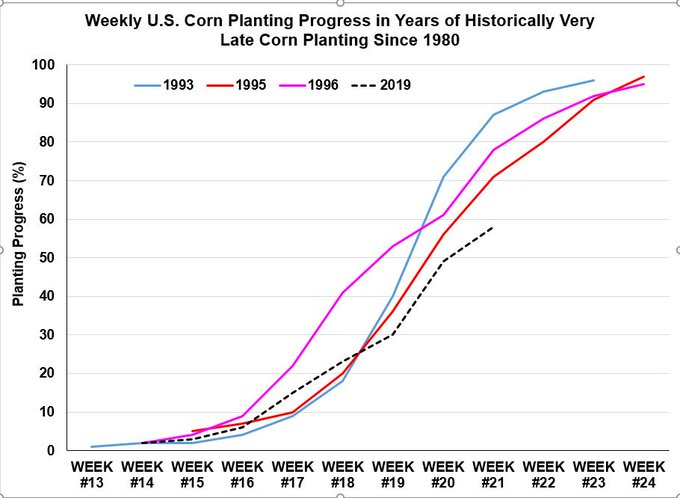

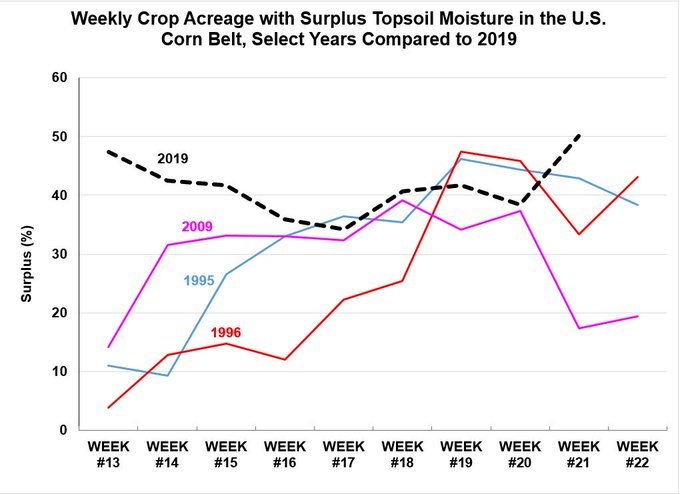

All of this year’s flooding is due to both early spring snowmelt and seemingly endless rain: Since the start of 2019, much of the lower Ohio and lower Mississippi River Valleys have picked up more than 2 feet of rain. A few spots have even received over 40 inches of rain, the Weather Channel said.

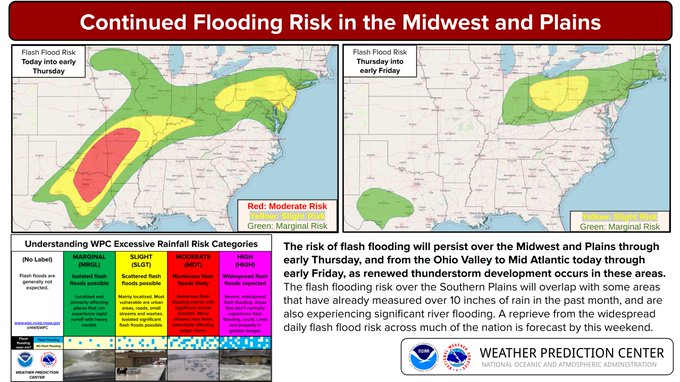

Shelby Fleig reported in Wednesday’s Des Moines Register that, “A jet-stream pattern stuck over the Midwest has pummeled Iowa with tornadoes, severe thunderstorms, hail and heavy rainfall in recent days. More of the same is expected this week, forecasters say, increasing chances for flash floods in parts of the state.”

The article noted that, “‘The ground really can’t hold any more water,’ [Brooke Hagenhoff, a meteorologist with the National Weather Service] said.”

Weekly Weather and Crop Bulletin- Volume 106, No. 22. USDA- Office of the Chief Economist (May 29, 2019).

Writing in Wednesday’s Omaha World-Herald, Nancy Gaarder, Jeffrey Robb and Erin Duff reported that, “Two and a half months after historic flooding, rising rivers on Tuesday were again closing roads and threatening homes and businesses in eastern Nebraska and western Iowa.”

“Over the last week, rainfall totals in the region have been running at 400% to 600% above normal, according to the National Weather Service.”

The risk of flash flooding will persist over the Midwest and Plains through early Thursday, and from the Ohio Valley to Mid Atlantic today through early Friday, as renewed thunderstorm development occurs in these areas. pic.twitter.com/XK7JJhKWiC38

Also Wednesday, Associated Press writer Jeff Amy reported from Mississippi that, “More than 500 homes have been damaged in flooding across a region where cotton, corn and soybeans are the main crops. Farmers are resigning themselves to missing the growing season entirely. Corn and cotton should already be in the ground, and farmers say there’s no way fields will be dry enough to plant soybeans by the end of June. Even then, removing debris from the fields will be a major job.”

Planting Progress Creeps Forward

With this background in mind, Bloomberg News reported Wednesday that, “U.S. farmers, which grow a third of the world’s corn and soybeans, have faced weeks of sluggish spring fieldwork as precipitation continues across the grain belt.

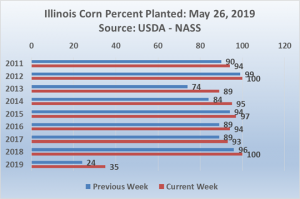

Just 58% of the nation’s corn crop was planted as of May 26, the lowest on record for this time of year, and the rate of soybean seedings is the least since 1990, government data released [Tuesday] showed.

“The risk of shrinking production has sent crop prices climbing, and the storms have yet to abate. Parts of Iowa, Illinois and Missouri are under warnings for flash floods, according to the National Weather Service. Some farmers are running up against deadlines to plant crops and still be covered under insurance policies to protect against losses in yield and price.”

Graph from USDA- National Agricultural Statistics Service.

The Bloomberg article added that, “The past 12 months have marked the U.S.’s wettest stretch on record. The U.S. corn planting pace released [Tuesday] trailed all analyst estimates in a Bloomberg survey and compared with 90% a year earlier. Prospects may improve in early June as the wet weather pushes farther south, though Midwest storms are set to resume afterward, according to Maxar.”

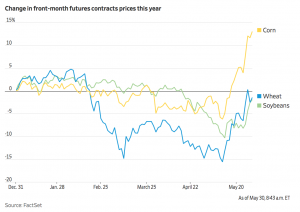

Financial Times writer Emiko Terazono reported on Wednesday that, “Corn prices popped to a 3-year high after a severe delay in plantings in the US midwest due to extreme wet weather.

“CBOT corn was trading above $4.38 a bushel, the highest since June 2016. Corn prices have soared 24 per cent since the start of the month amid wet weather conditions.”

“Corn prices jump to 3-year high amid extreme wet weather,” by Emiko Terazono. The Financial Times (May 29, 2019).

“‘The window for corn planting is gradually closing if the risk of yield shortfalls is not to increase significantly,’ said analysts at Commerzbank.”

Scott Irwin@ScottIrwinUI · May 29, 2019Replying to @ScottIrwinUI

11. Given the wet conditions and rain this week, I am probably being a bit generous, but I project that an additional 9% of US corn crop will be planted this week. Same progress as last week. That will bring us up to a whopping 67% next Sunday, June 2nd.

12. My planting progress forecast for this week implies that one-third, yes that’s right, one-third of the US corn crop will be unplanted as of June 2nd. That is 31 million acres. You can fuss with the assumptions but we are not going to be too far from that number. pic.twitter.com/OECsCP2q5M90

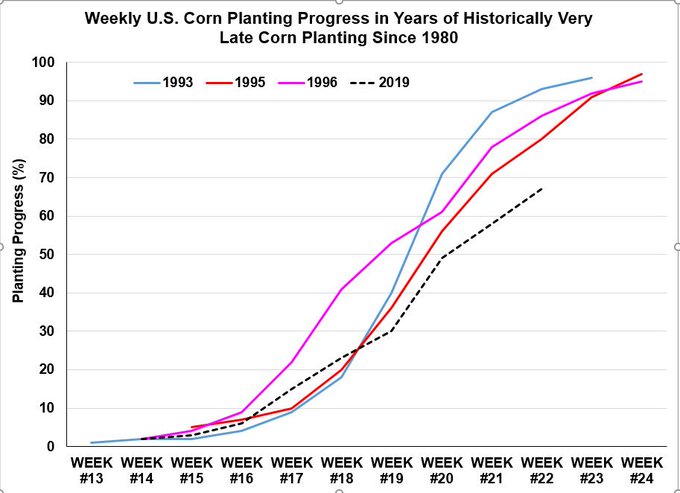

The FT article also pointed out that, “There are growing concerns about soyabean planting, with just 29 per cent of fields planted, lagging far behind the five-year average figure of 66 per cent.”

Graph from USDA- National Agricultural Statistics Service.

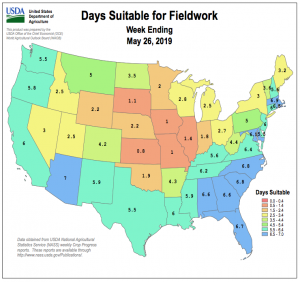

And Reuters columnist Karen Braun indicated on Tuesday that, “This year’s U.S. planting delays have been caused by persistently wet weather on top of a record-wet off-season that saturated the soils. Farmers generally cannot plant seeds into overly wet soils because heavy equipment can easily get stuck. Once planted, the eventual roots may be too shallow to properly take in nutrients and moisture throughout the summer.”

5. So, we know US corn planting progress is terrible and that around 39 million acres are left to plant (as of last Sunday). Key question seems to be how much can be planted this week and next? Most discussion I see is around price needed to buy acres out of PP.

6. I think we should instead focus first on the simpler question of what corn planting is Mother Nature going to allow in the next two weeks. I think this chart is critical to help answering that question. pic.twitter.com/tYHXFfrso935

Meanwhile, a Prairie Farmer article this week noted that, “Scott Irwin, University of Illinois ag economist, says Illinois has a history of taking very few prevented planting crop insurance claims compared to other states. He predicts 2019 will be different.

“‘We’re facing the unprecedented situation of a large chunk of the U.S. corn crop either being planted in the first few weeks of June or not being planted at all,’ Irwin says. ‘I’m very confident that prevented planting will be at a level in Illinois we have never seen before.’”

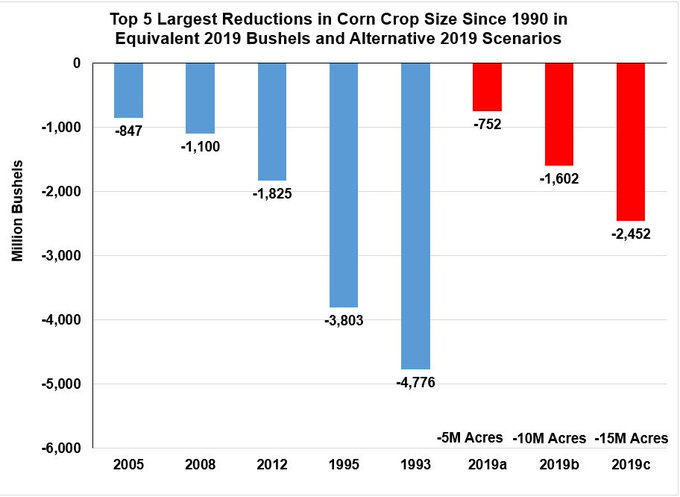

2. Went back and looked at historical changes in total US corn production YOY from 1990-2018. Computed % YOY changes for each year. I then multiplied the % changes for each year by 2018 production in bushels. That way changes are normalized for growing production over time.

3. Chart shows Top 5 largest “normalized” changes in corn production over 1990–2018 and three scenarios for 2019. All of the 2019 scenarios assume a national average yield of 170bpa. Given these assumptions, is 2019 looking like a “historic” production decline? pic.twitter.com/Whm7ZRohoq6

With respect to corn price implications of this season’s wet spring, earlier this week farmdoc’s Todd Hubbs stated that, “Reduced acreage and lost yield potential for the 2019 corn crop look to drive prices higher as the wet weather continues to cover much of the Corn Belt.”

Dr. Hubbs added that, “Uncertainty about the size of the 2019 corn crop will continue for the next few months. Corn prices appear set to take on the pattern of a price spike and long tail associated with a crop shortfall. Corn marketing in 2019-20 should reflect this reality.”

And Joe Wallace reported on Thursday at The Wall Street Journal Online that, “Crop prices are vaulting higher as massive disruption on U.S. farms raises concerns about the size and quality of this year’s harvest.

“Prices began taking off in mid-May, after inclement weather put farmers well behind in their planting schedules and raised worries that swaths of farmland wouldn’t be sown at all. The surge continued after the U.S. Department of Agriculture confirmed that farmers had planted a fraction of what they have typically done by this time of year.”

“Corn Prices Climb on Worries Over Size, Quality of Harvest,” by Joe Wallace. The Wall Street Journal (May 30, 2019).

The Journal article explained that, “Corn futures have leapt more than 14% in May, putting them on course for their best month since June 2015. They reached a three-year high of $4.38 a bushel on Wednesday. Wheat prices have jumped 13%, on track for their biggest one-month rise since April last year.

“Soybeans remain hamstrung by the trade dispute between Washington and Beijing and an epidemic afflicting China’s pig herd, which has reduced global demand for animal feed. They have risen less than 2%.”

Mr. Wallace added that, “Farmers could decide to sow land originally slated for corn with soybeans, which in some states can be planted until July. However, some are considering leaving the fields fallow and filing for insurance payouts, possibly taking a chunk out of next year’s crop supply. That could also drive prices higher.”

For a detailed analysis of variables that farmers might want to consider when making planting decisions in this unprecedented environment, see this farmdoc daily update by Gary Schnitkey: “Prevented Planting, 2019 Market Facilitation Program Payments, Disaster Assistance, and Price Dynamics.”

Source: Farm Policy News