Phase-Two Deal with China Unlikely, as U.S. Corn Exports Continue

Josh Zumbrun and Catherine Lucey reported on the front page of Saturday’s Wall Street Journal that, “President Trump damped expectations for a promised phase-two trade pact with China on Friday, saying the relationship between the countries has been too badly damaged by the coronavirus pandemic.

“‘I don’t think about it now,’ Mr. Trump told reporters aboard Air Force One, where he criticized China’s response to the new coronavirus, which continues to spread rapidly throughout the U.S. ‘They could have stopped the plague, they could have stopped it, they didn’t stop it.’

“A spokesman for the Chinese Embassy in Washington didn’t immediately respond to a request for comment.”

The Journal article noted that,

The economic fallout from the pandemic also made it increasingly unlikely that China would meet its targets for expanded purchases of U.S. goods under the phase-one deal, fueling further doubts about prospects for new talks.

Bloomberg writer Jennifer Jacobs explained on Friday that, “When the two nations agreed to the first phase trade deal in January, Trump said that talks on a second phase could start right away but might not finish until after the Nov. 3 general election. Since then, the two countries have been wrangling over the implementation of the initial agreement, and Phase 2 was contingent on the first rounds going well.”

Meanwhile, Bloomberg writers Michael Hirtzer and Mike Dorning reported late last week that, “China is making further moves to try to link the spread of coronavirus and food shipments. And yet again, U.S. officials are rebuffing the attempt, emphasizing what’s considered to be the established science on the matter — that no proof of that link exists.”

China has been stirring the pot over whether the pathogen can spread through food or frozen products, drawing the connection against the advice of global health experts and authorities.

“Last month, the Asian country pointed to imported salmon as a possible culprit for Beijing’s fresh Covid-19 outbreak, sparking a boycott of the fish as supermarkets took the produce off their shelves. China also began mass testing of cold food imports at ports, and blocked shipments from meat plants abroad that reported infections among workers.”

Hirtzer and Dorning pointed out that, “In the latest move, China halted imports from three Ecuadorian plants linked to the shrimp samples. The announcement created a new level of uncertainty in the global meat, poultry and seafood trade that further shipments or sales could be disrupted.”

In other news regarding U.S., China trade, Reuters writer Karl Plume reported late last week that, “China booked its second-largest single-day U.S. corn purchase on record, according to U.S. Department of Agriculture (USDA) data released on Friday, as the country works to fulfill its Phase 1 trade deal obligation to dramatically increase U.S. farm product imports.

“The USDA said China bought 765,000 tonnes of corn for shipment in the current marketing year which ends Aug 31 and 600,000 tonnes for shipment in the following year.”

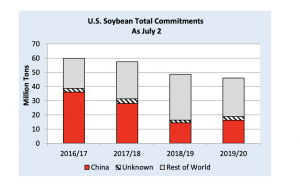

The Reuters article noted that, “China on Friday increased its corn and soybean import forecasts for the current season, as the country was expected to step up purchases from the United States.”

And a report Friday from USDA’s Foreign Agricultural Service (FAS) (“Grain: World Markets and Trade“) stated that, “Combined [Chinese] imports of corn and sorghum are up sharply from a year ago, more than offsetting smaller imports for barley. This may also reflect implementation of the U.S.-China Phase One Agreement. Regardless, demand for competitively priced feed grains runs strong as China’s corn harvest is still a few months away.”

With respect to Chinese protein imports, FAS stated in a separate report Friday (“Livestock and Poultry: World Markets and Trade“) that, “Demand for imported meat in China remains incredibly strong as the protein deficit caused by African swine fever (ASF) continues to drive trade. Despite headwinds caused by COVID-19 and disruptions to the economy and foodservice, demand growth during the first 5 months of the year exceeded expectations.

“As a result, forecasts for pork, beef, and chicken meat imports are all revised upward. China continues to increase its share of the global market, accounting for over 43 percent of global pork imports and 29 percent of beef. All together, China now accounts for 28 percent of imports by major traders, up from 20 percent in 2019.”

Source: Keith Good, Farm Policy News