IFES 2020-Grain Farm Incomes in 2020 and 2021

This is a presentation summary from the 2020 virtual Illinois Farm Economics Summit (IFES). A video of the webinar and PowerPoint Slides (PDF) are available here.

Expectations of net incomes on Illinois grain farms changed over 2020. Above trend yields in 2020 combined with higher corn and soybean prices will lead to higher 2020 crop revenue than in many recent years. Higher crop revenue combined with additional government support will cause average incomes on Illinois grain farms to be higher in 2020 than in recent years. The outlook for 2021 income has brightened relative to expectations in the summer of 2020.

2020 Farm Incomes

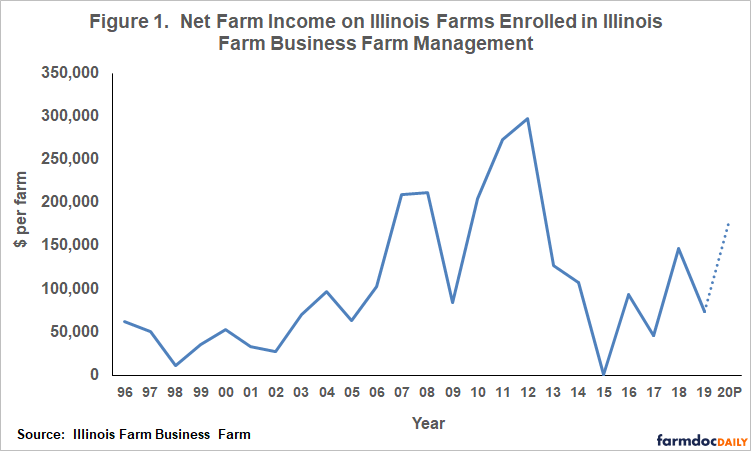

Net incomes on Illinois grain farms reached relatively higher levels for the years from 2006 to 2013 (see Figure 1). From 2006 through 2013, net incomes average $201,000 per farm on farms enrolled in Illinois Farm Business Farm Management (FBFM). Higher incomes resulted from the increasing use of corn in producing ethanol, continued growth in U.S. soybean exports, and supply shortfalls in significant agricultural areas from 2010 to 2012. The build-up in corn use in ethanol came to an end in 2013, and most agricultural regions have had had good yields since 2012. As a result, commodity prices have been lower since 2013, leading to lower net incomes. From 2014 to 2019, net income on FBFM farms averaged $78,000. Incomes in 2019 averaged $74,000.

At the beginning of 2020, expectations were for 2020 incomes to be at relatively low levels because of continued difficulties in exporting agricultural goods due to trade difficulties, with potentially continued lower U.S. soybean exports to China bringing a cloudy outlook for Illinois farms. The coronavirus and related COVID control measure further darkened the outlook, with sharp declines in commodity prices occurring beginning in April. These low prices continued through summer, with cash prices for corn near $3.00 per bushel and soybean prices being near $8.00 per bushel in August.

Outlook changed considerably in August. Hot, dry weather over much of the Midwest led to lower estimates of U.S. yields. A rare Derecho storm impacted yields in Iowa and parts of northern Illinois, Expectation of Iowa corn yields fell from 202 bushels per acre in August to 184 bushels in November. These lower yields had a positive impact on price. Also impacting prices were growth in exports, as supply problems in China lead to increases in both soybean and corn exports to China.

Many Illinois farms still had above trend yields. These above-trend yields combined with higher prices since August led to higher expectations of crop revenue in 2020.

In addition to higher crop revenue, most Illinois farms received additional ad hoc Federal payments. The Coronavirus Food Assistance Program (CFAP) was instituted to aid agricultural producers in dealing with COVID control measures. Also, some Illinois farms participated in Small Business Administration (SBA) programs, including the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). These Federal programs will contribute a significant amount of revenue to many Illinois farms.

Overall, Illinois grain farms are now expected to have net incomes above the $78,000 average between 2013 and 2019, perhaps nearing $200,000 per farm. Again, these higher incomes were caused by above-trend yields, higher commodity prices, and ad hoc Federal payments.

2021 Net Incomes

There is a great deal of uncertainty concerning 2021 incomes, as is always the case in the winter before production. Currently, 2021 fall bids are above $4.00 per bushel for corn and $10.00 per bushel for soybeans. Except for 2019, Illinois state yields have been above trend since the 2012 drought year. A continuation of above-trend yields combine with current fall bid prices would lead to net incomes above the 2013-2019 average. Of course, above-trend yields could lead to higher supply and downward pressures on cash grain prices.

Also cloudy is whether ad hoc Federal aid will continue. The Market Facilitation Program instituted in 2018 to offset lower prices caused by trade difficulties contributed significantly to incomes in 2018 and 2019. The CFAP payments were important cash flows in 2020. Presidential or congressional actions are needed to continue programs like MFP and CFAP into 2021. Whether that occurs is an open question, further clouded by a new administration and new Congress taking office in January.

Summary

At the beginning of 2020, expectations were for low 2020 net incomes. The institution of COVID-19 measures further lowered income expectations. In the end, however, above-trend yields, higher prices were higher, and continued Federal aids have led to exceptions of higher 2020 incomes. Outlook for 2021 is relatively bright at this point. However, events of 2020 illustrate how quickly income outlook can change. In the end, events could cause prices to change dramatically from current levels.

Source: Gary Schnitkey and Dale Lattz, Farmdocdaily