Federal Reserve: Observations on the Ag Economy- October 2019

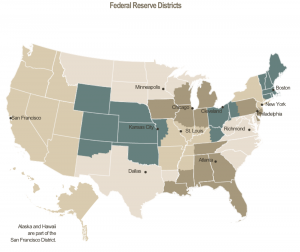

On Wednesday, the Federal Reserve Board released its October 2019 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

Graph of Fed Districts from, “The Beige Book.”

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Reports indicated much of the District was drought-free, although parts of Alabama, Georgia, the Florida panhandle, and Tennessee continued to experience abnormally dry to moderate drought conditions.

U.S. Drought Monitor- Southeast (October 17, 2019).

“The USDA designated several counties within the District as natural disaster areas due to damages and losses attributed to several inclement weather events this year. Cotton, corn, and peanut production forecasts were ahead of last year’s production while rice and soybean production forecasts were below. On a year-over-year basis, prices paid to farmers in July were up for corn and beef but down for cotton, rice, soybeans, broilers, and eggs. However, on a month-over -month basis, prices increased for corn, cotton, rice, and soybeans but declined for beef, broilers and eggs.”

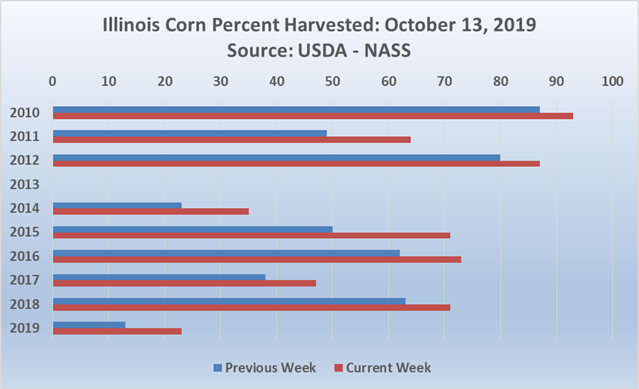

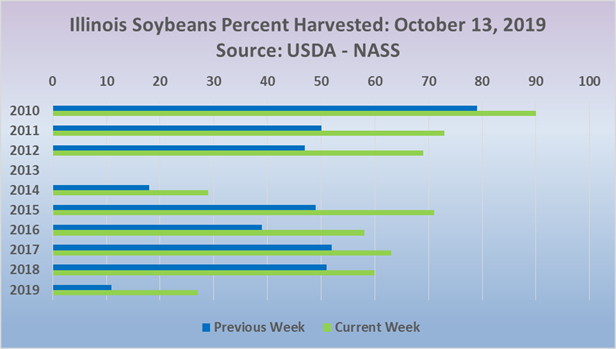

* Seventh District- Chicago– “The corn and soybean harvest got off to a slow start in the District, as rains delayed fieldwork. In addition, the harvest started later than usual because heavy spring rains had delayed planting and crops were up to a month behind in maturity.

Farm Policy@FarmPolicy

#Illinois #corn percent harvested @usda_nass

Farm Policy@FarmPolicy

#Illinois #soybeans percent harvested @usda_nass

“Contacts had mounting concerns about how much of this year’s crop would be able to fully mature before a hard frost hits.

Weekly Weather and Crop Bulletin. USDA- Office of the Chief Economist (Vol. 106, No. 42- October 16, 2019).

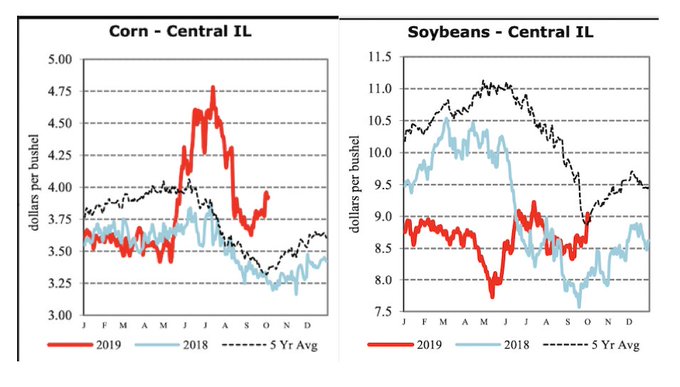

“Overall, contacts expected the harvest to be well below those of recent years. Corn and soybean prices moved higher, especially toward the end of the reporting period.

Farm Policy@FarmPolicy

Daily #Grain Review- Tuesday, Oct 15, 2019 https://bit.ly/2VzxRkQ @USDA_AMS

* #Corn, #soybeans central #Illinois (2019, 2018, and five year average).

“Egg and dairy prices were up, but hog and cattle prices drifted down. Contacts noted that although there was still uncertainty about the size of China’s purchases of agricultural products, there was positive news for farmers in the newly announced trade deal with Japan and in recent adjustments to the implementation of the Renewable Fuels Standard that will support demand for biofuels.”

* Eighth District- St. Louis– “District agriculture conditions have declined modestly compared with the previous report. Production and yield forecasts fell for corn and soybeans from August to September but improved for cotton. Expected rice production also declined over the same period, but expected yields ticked up. Relative to 2018, corn, rice, and soybean production levels are projected to decrease sharply, largely due to the unusually wet weather and flooding during the planting season. However, cotton production levels are expected to improve compared with last year. The outlook among contacts remained relatively pessimistic due to depressed commodity prices and trade uncertainty. Farmers in southern Indiana also expressed concern over the recent lack of rain.”

* Ninth District- Minneapolis– “District agricultural conditions remained weak.

Heavy rains that hampered crop planting this season have persisted into the fall and may complicate harvests in some areas, according to sources. Recent forecasts indicated that corn and soybean production in District states may decrease 10 percent and 20 percent, respectively, in 2019 compared with last year.

* Tenth District- Kansas City– “Agricultural economic conditions in the Tenth District generally remained weak. Major row crop and cattle prices were generally stable following sharp declines in the prior period. U.S. corn and soybean production was expected to decline slightly in 2019, but not enough to materially reduce large outstanding supplies.

In contrast to other areas of the U.S., a slight increase in corn production was expected throughout the region and could contribute to a slight improvement in revenues. Conversely, soybean production was expected to be moderately lower, and prices continued to be damped by on- going trade disputes.

“In the livestock sector, recently disrupted beef production channels continued to put downward pressure on cattle prices, but stronger pork exports drove a moderate increase in hog prices.

Farm Policy@FarmPolicy

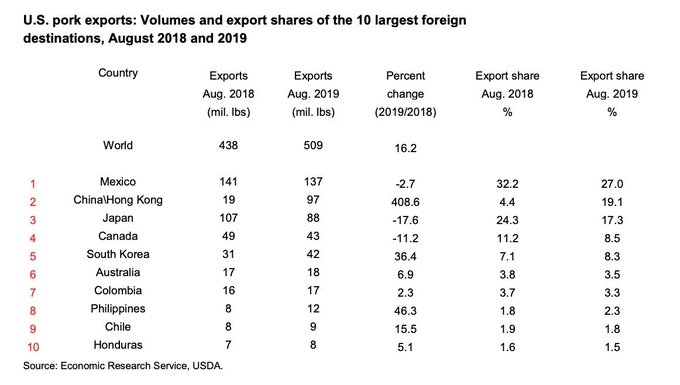

U.S. #pork #exports in August were 509 million pounds, more than 16 percent higher than a year ago. https://bit.ly/2OSE1MB @USDA_ERS

Trade data indicate that #China\Hong Kong accounted for a share of U.S. exports in August that was ~15 percentage points higher than a year ago.

“In addition, the distribution of 2019 USDA trade relief payments could provide additional short-term support to farm cash flows.”

USDA- Economic Research Service Webinar, “Farm Income and Financial Forecasts, August 2019” (August 30, 2019).

* Eleventh District- Dallas– “Hot and dry weather continued across most of the District, with some parts of Texas entering severe to extreme drought. As a result, crop and pasture conditions deteriorated over the reporting period, though harvest was already well underway for row crops.

U.S. Drought Monitor- Texas (October 17, 2019).

“Yields were favorable for much of the 2019 corn and sorghum crop, which at current crop prices has allowed many producers to cover their costs. Wheat and cotton yields were good but prices were below break-even levels. Contacts report a bearish outlook for cotton prices as export and domestic demand estimates are being cut due to slower economic growth, and supply estimates are not being cut as much as anticipated. Trade issues were still very prominent on the minds of agricultural producers, however some contacts reported more optimism regarding a resolution.”

* Twelfth District- San Francisco– “Activity slowed further in the agricultural sector. Poor weather in Idaho damaged wheat harvests, while potato yields were lower than last year due to poor growing conditions earlier in the season. The outlook for Idaho’s corn crop was similarly weak due to colder-than-usual conditions.

Demand for agricultural exports continued to run soft, with contacts generally citing tariffs and slower global growth as reasons for the decline in exports.

“A lumber producer in Oregon noted that lumber exports to China have dropped so much that the industry has started scaling back harvesting capacity to preserve domestic prices. An apple grower in Washington reported an oversupply of fruit in the market, and contacts in California noted that cherry and nut exports to China were down noticeably. Demand from abroad for various meat products was also weak due to tariffs, though a negative supply shock in the Chinese pork industry continued to drive stronger-than-usual demand for swine exports. A contact in California reported that demand for farmland has fallen recently due to realized and potential effects of trade policy developments, resulting in moderating land prices.”

Source: Keith Good, Farm Policy News