Federal Reserve-Observations on the Ag Economy- May 2020

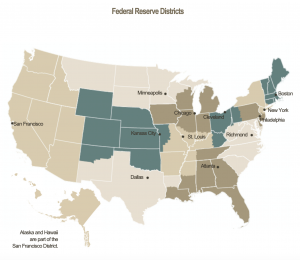

On Wednesday, the Federal Reserve Board released its May 2020 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

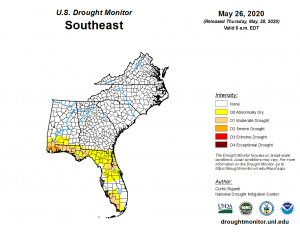

* Sixth District- Atlanta– “Agricultural conditions softened. Most of the District remained drought free, with the exception of much of Florida, southern Louisiana, and other parts of the Gulf coast region, which experienced abnormally dry to severe drought conditions.

“On a month-over-month basis, the April production forecast for Florida’s orange crop was down from last month’s forecast and last year’s production, while the grapefruit production forecast was down from last month’s forecast but ahead of last year’s production. The USDA reported that for March, year-over -year prices paid to farmers were up for corn, rice, eggs, and milk but down for cotton, soybeans, cattle, and broilers. On a month-over-month basis, prices increased for broilers and eggs but decreased for corn, cotton, rice, soybeans, beef, and milk.”

* Seventh District- Chicago–

Agriculture incomes fell over the reporting period as most commodity prices fell.

“Contacts reported disruptions in the supply chain for meats, dairy, and vegetables. The disruptions were particularly notable for meats, as coronavirus outbreaks forced a number of packing plants to suspend operations. Some packers restarted, but output was substantially lower than a year ago. With no place to deliver market-ready animals, farmers were forced to slow herd growth (including by euthanizing hogs).

Weekly #Livestock, Poultry & #Grain Market Highlights https://t.co/s0MdMxU3JQ @USDA_AMS

* #pork production.

* #beef production. pic.twitter.com/l8DsYSK6hx

— Farm Policy (@FarmPolicy) May 26, 2020

“On net, the supply disruptions led to higher prices and shortages of meat at grocery stores and restaurants, but lower prices for cattle and hogs. Milk prices also fell, with some producers dumping milk. Some ethanol plants accepted corn deliveries again, but corn prices remained low. Soybean prices also fell, but were favorable relative to corn, resulting in some shift toward planting beans.

“Planting progress was ahead of last year. Late freezes damaged some crops, particularly fruit trees. Farmers anticipated government programs would help during the downturn, but observers expected some distressed farms to be forced to liquidate.”

* Eighth District- St. Louis– “District agriculture conditions have been mixed since April. Contacts reported that transportation and warehousing costs have increased and supply chain issues are affecting many producers. Smaller meat processing plants experiencing higher demand due to closures of larger plants are constrained by regulatory requirements. Contacts reported significant variation in revenue as some industries such as rice producers have seen increased demand and prices for their goods. Meanwhile, cotton and other row crop producers reported lessened demand and continued low commodity prices, making profitability a challenge. Planting has increased since the previous reporting period and is up modestly from this time in 2019. However, this is largely due to improvements in states that experienced historic flooding in 2019.”

* Ninth District- Minneapolis– “District agricultural conditions worsened. Reports continued to surface of producers euthanizing animals or placing them on restrictive diets due to pandemic-related closure of livestock slaughter plants. More than two- thirds of Ninth District agricultural lenders reported that farm incomes decreased in the previous three months relative to a year earlier, with a similar share reporting decreased capital spending, according to the Minneapolis Fed’s first-quarter (April) survey of agricultural credit conditions.”

* Tenth District- Kansas City–

The farm economy in the Tenth District weakened further alongside developments related to COVID-19.

“As of the second week of May, roughly a quarter of U.S. meat- packing and food processing plants with confirmed COVID-19 cases were located in the District. As disruptions in meat and food supply chains worsened and a substantial slowdown in ethanol production continued, cattle and corn prices declined sharply through early May. Alongside significant reductions in demand for corn used in ethanol, corn supply also was forecasted to be the largest on record in 2020.

Ending #corn stocks are pegged at 3,347 million bushels, an increase of 1,220 million from last year, the highest since 1986/87’s 4,882 million.

The stocks-to-use ratio is 22.6, the highest since 1992/93, https://t.co/sTPvJLQ2sJ @USDA_ERS pic.twitter.com/RT8zYTyrWf

— Farm Policy (@FarmPolicy) May 24, 2020

“Contacts reported that weak market conditions likely will have major implications for producer cash flows in coming months. Despite a more pessimistic environment, farmland values in the region remained relatively steady.”

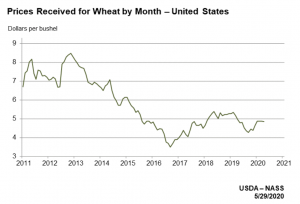

* Eleventh District- Dallas– “Soil moisture levels remained favorable across most of the district, except for South Texas where there was drought. Wheat remained a bright spot with higher prices, strong demand, and solid yield prospects.

“Prices fell for other grain crops, particularly corn, due to declining ethanol demand. Contacts noted some concern for 2020 revenues in part due to lower grain prices. Reduced meat processing capacity due to social distancing measures and plant closures translated into lower demand and prices for cattle, even as beef prices soared.”

* Twelfth District- San Francisco– “Activity in the agriculture sector slowed further over the reporting period. Domestic demand from the commercial food sector continued to be just a fraction of what it was before the COVID-19 shock. Potato and barley growers in Idaho faced reduced sales to distributors who had retained leftover inventory from the previous season. Fruit growers in California saw some increased demand from food banks, social service providers, and governmental programs, but, a decline overall in domestic demand. Timber producers in the Pacific Northwest also saw a pullback in domestic demand for logs due to the slowdown in manufacturing activity. On the supply side, some producers in Idaho and Arizona have reduced live animal herd sizes in response to bottlenecks at meat processing plants. Agricultural export markets were similarly downbeat. Milk exports declined notably. Slow-downs in the entertainment and restaurant sectors abroad hit exports of nuts and raisins.”

Source: Keith Good, Farm Policy News