Federal Reserve Ag Credit Surveys-2019 Fourth Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the fourth quarter of 2019. And earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the fourth quarter of 2019. Meanwhile, a recent update posted at the Federal Reserve Bank of St. Louis, which has also historically released quarterly farm credit conditions, stated that, “The St. Louis Fed’s Agricultural Finance Monitor has been discontinued.” Today’s update highlights core findings from the Fed reports.

Farm Policy@FarmPolicy

I always found this to be a valuable resource, sorry to hear that this report has been discontinued.

* The @stlouisfed’s #Agricultural Finance Monitor has been discontinued

Federal Reserve Bank of Chicago

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “On the whole, there was no annual change in ‘good’ agricultural land values in the District for 2019; that is, the District’s farmland values in the fourth quarter of 2019 were essentially the same as a year ago (see table and map below).

“In the fourth quarter of 2019, Indiana and Iowa experienced year-over-year increases in agricultural land values of 2 percent, whereas Illinois and Wisconsin experienced decreases of 1 percent and 2 percent, respectively. (Compared with a year ago, Michigan farmland values seemed to be flat, yet not enough Michigan bankers responded to provide a conclusive result.) The District’s farmland values increased 1 percent in the fourth quarter of 2019 relative to the third quarter.”

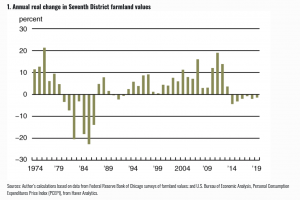

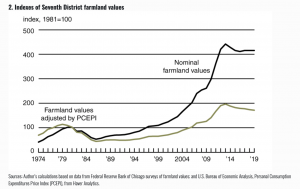

The AgLetter stated that, “With inflation taken into account, District farmland values had a yearly decrease of a little over 1 percent in 2019; in real terms, the decrease in 2019 was smaller than the one in 2018 because of a dip in inflation.

“This was the sixth straight annual real decline. District farmland values fell 13 percent in real terms from their peak in 2013 to the end of 2019. But the decrease in agricultural land values over this span was just 6 percent in nominal terms.”

The Chicago Fed pointed out that, “Weather challenges hurt the five District states’ crop production in 2019—which helped keep farmland values from changing.”

ChicagoFed

✔@ChicagoFed

Just Released: “Based on calculations using @USDA_ERS data, the District states’ #corn yield fell to 183 bushels per acre in 2019—down 5.8% from 2018.” Oppedahl explains how crops affected #agriculture land values and finance in 2019Q4 in the AgLetter. https://bit.ly/2G5H6Rh

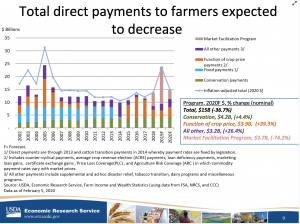

“Overall, the USDA planned to distribute $14.5 billion to farmers in order to counter negative impacts from limitations on agricultural exports in 2019. A substantial portion of the MFP payments went to District states. Given higher levels of government support and higher prices for some products, the USDA forecasted an almost $10 billion increase in net farm income for 2019 nationwide.”

Mr. Oppedahl added that, “District agricultural credit conditions exhibited signs of improvement in the fourth quarter of 2019. The share of the District farm loan portfolio indicated as having ‘major’ or ‘severe’ repayment problems was 5.8 percent in the fourth quarter of 2019—lower than the share reported in the final quarter of 2018.”

“The survey results reflected some cautious optimism about agriculture’s prospects in 2020. Survey respondents indicated that at the beginning of 2020, only 2.2 percent of their farm customers with operating credit in the year just past were not likely to qualify for new operating credit in the year ahead—this was a slight improvement from what was reported at the start of 2019,” The AgLetter said.

Federal Reserve Bank of Kansas City

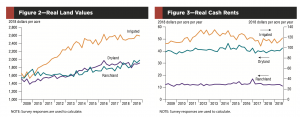

Cortney Cowley and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farmland values increased slightly in the fourth quarter, and cash rents remained stable. Nonirrigated farmland values trended higher at a modest pace in 2019 and increased 4 percent in the fourth quarter. Cash rents have trended lower since 2017 but increased slightly at the end of 2019. In the fourth quarter, cash rents were 2 percent above year-ago levels.”

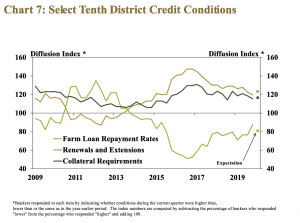

Thursday’s update stated that, “Agricultural credit conditions throughout the District remained relatively weak through year-end, but the pace of deterioration slowed. About a quarter of all bankers continued to report a decline in repayment rates, but it was the lowest share in more than four years.”

Cowley and Kreitman also noted that, “Alongside slower deterioration in other credit indicators, farm income also decreased at a slower pace. About 40 percent of bankers indicated that farm income declined from a year ago, but that was the lowest share since 2014. Government payments (Market Facilitation Program) connected to trade disputes provided financial support to many producers in 2019. However, farm income in the District remained relatively weak alongside generally low agricultural commodity prices and subdued farm revenues.”

In summary, Thursday’s report stated that, “In the fourth quarter, farmland values strengthened, providing some stability for the Tenth District farm economy. Reduced borrowing costs and strong demand may have contributed to recent strength in land values.

Although farm income and credit conditions remained weak, most indicators appeared to stabilize. Some bankers commented on the positive support from trade relief payments, but a larger share of bankers expressed concerns about persistently low commodity prices.

“In addition to the future path of agricultural prices, the outlook for agricultural credit conditions through 2020 also may depend on prospects of additional support from government payments.”

Federal Reserve Bank of Dallas

Earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the fourth quarter of 2019, which stated that, “Demand for agricultural loans continued to decline, with the loan demand index registering its 17th quarter in negative territory. Loan renewals and extensions increased, and the rate of loan repayment continued to decline. Loan volume fell across all major categories compared with a year ago.”

The Dallas Fed added that, “District irrigated cropland values stabilized this quarter, while dryland values held steady and ranchland values increased moderately.”

“The anticipated trend in farmland values index increased slightly after being flat for a year, suggesting respondents expect farmland values to pick up moderately,” The Survey said.

Source: Keith Good, Farm Policy News