FAS Report: Corn Ethanol Production Booms in Brazil

A report earlier this month from USDA’s Foreign Agricultural Service (FAS), Corn Ethanol Production Booms in Brazil, stated that, “Plentiful, and generally cheap, corn supplies in Brazil’s Center-West region have enticed investment in the corn ethanol sector over the last few years. There are currently 16 corn ethanol plants in the Center- West states of Mato Grosso, Goias, and Mato Grosso do Sul. At least four units are corn-only plants, while the rest are flex-plants that produce ethanol form both sugarcane and corn.

Industry sources report at least seven other corn-based ethanol plants in the planning, development, or construction stage. These plants could potentially start operations in 2021 or 2022, including projects in the states of Sao Paulo and Rondonia.

“Even though Brazilian ethanol demand has dropped in 2020, due to the COVID-19 pandemic, investors are optimistic that the market will rebound by the time construction on the plants is completed in 18-24 months. The Brazilian Corn Ethanol Union (UNEM) estimates that the sector will produce about 2.5 billion liters of corn-based ethanol in market year 2020/21. If all the ongoing projects are built as planned, Brazil’s corn ethanol production could top 5.5 billion liters per year, consuming more than 13 million metric tons (mmt) of corn annually.”

The FAS update explained that, “In addition to the expected increase in ethanol consumption in Brazil and abroad, another factor encouraging expansion of corn ethanol production in the country is the huge volume of the annual corn harvest. Over the last two decades, Brazil’s annual corn crop has more than doubled in volume, reaching an estimated 103 mmt in market year 2019/20. Much of that expansion has come from expanded second-crop corn, which is largely grown in Brazil’s Center-West region and is planted after the soybean harvest each year.”

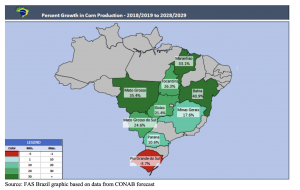

The report added that, “According to Brazil’s agricultural statistics agency, CONAB, production in the largest producing state, Mato Grosso, is forecast to expand by another 35 percent over the next decade, while the neighboring Center-West states of Goias and Mato Grosso do Sul are both expected to see corn production increase by more than 20 percent.”

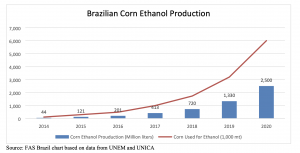

The FAS report pointed out that, “Total Brazilian corn-based ethanol production in 2020 is estimated at 2.5 billion liters, an increase of 1.17 billion liters compared to 2019. Post estimates that corn ethanol will represent 8 percent of Brazil’s total ethanol production in 2020, given that ethanol production from sugarcane is expected to drop as the sugar market has been more attractive, and the domestic fuel market has been hit by the COVID-19 pandemic. Total corn used to produce corn-based ethanol in 2020 is estimated at roughly 6 mmt, an increase of 88 percent compared to the corn volume consumed in 2019, and representing about 6 percent of the corn crop in market year 2019/20.

“The graph below shows the evolution of corn used for ethanol production and total corn ethanol production in Brazil since the early stages of the industry. Note that each ton of corn can produce approximately 417 liters of ethanol, 313 kilograms of DDGS, and 18 liters of corn oil, as well as the co- generation of electric power, which most plants sell back to the grid.”

FAS also indicated that, “While corn ethanol production still accounts for only a small fraction of Brazil’s overall ethanol production, the abundant supply of corn and growing domestic demand for ethanol, especially in the center of the country, where gasoline prices are higher, likely mean that Brazil’s corn ethanol production will continue to expand.”

Source: Keith Good, Farm Policy News