FAS Report- Biggest Challenge For U.S. Ag Trade With China: Strong Competition, Especially From Brazil

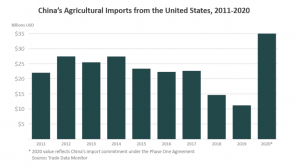

A recent report from USDA’s Foreign Agricultural Service (FAS), “China: Evolving Demand in the World’s Largest Agricultural Import Market,” stated that, “As part of the Phase One Agreement, China has committed to purchase $12.5 billion more agricultural and related products from the United States over 2017 levels.

“After a slow start in the first quarter, U.S. agricultural exports to China increased pace in April through July, with shipments exceeding seasonal trend.

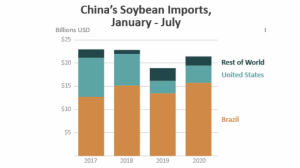

However, from January-July, U.S. agricultural exports to China were still 16 percent (or $1.3 billion) below the same period in 2017, largely due to lagging soybean shipments.

“Export sales of soybeans have accelerated in recent months, while sales and shipments of grains have also picked up steam.”

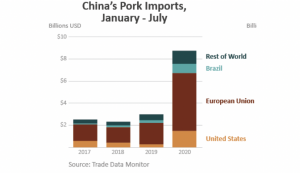

The FAS report added that, “Year-to-date U.S. consumer-oriented product exports to China have more than doubled from 2017 levels, led by record pork shipments. China’s pork and pork product imports have more than tripled so far this year as ASF [African Swine Fever] continues to put upward pressure on prices. While both the EU and the United States have captured some of the growth in China’s pork market, Brazil managed to expand its market share from 3 percent in 2017 to 10 percent currently.”

The report also noted that, “The trade data suggest that the biggest challenge facing U.S. agricultural trade with China thus far in 2020 is strong competition, especially from Brazil. It stands to note that, indirectly, the pandemic has led to a more favorable exchange rate for the Brazilian real, boosting the country’s competitiveness and helping it to ship record amounts of soybeans to China in the first half of the year.”

More specifically regarding U.S. exports, Reuters columnist Karen Braun stated on Friday that, “The new U.S. corn and soybean marketing year is just a month old, and the progress toward meeting big annual export targets is more advanced than normal in terms of sales, largely due to strong Chinese demand.

“U.S. corn and soybean export bookings stand at record levels for this early stage, and that bodes well for the expectation that 2020-21 shipments will rebound sharply from the dismal year-ago levels.

The Reuters column pointed out that, “China accounted for 54% of all 2020-21 U.S. soybean commitments as of late September. That is above the 2015-2017 average by the same time of 44% but below the 2012-2014 average of 62%.

Meanwhile, Reuters writer Christopher Walljasper reported late last week that, “China may fall short of annual agricultural product purchasing commitments made in its Phase 1 trade deal with the United States due to ‘non-agricultural trade issues,’ U.S. Department of Agriculture Secretary Sonny Perdue said on Friday.

“‘I’m not sure they’re going to make it, but they’re trying,’ Perdue said during a town hall meeting with farmers at Edge Dairy Farmer Cooperative. ‘Non-agricultural trade issues get in the way.’”

The Reuters article indicated that,

Chinese imports of U.S. agricultural products totaled just $8.6 billion from January through July, according to the latest U.S. Census trade data.

And Washington Post writer Eva Dou reported on Saturday that, “On the surface, China’s campaign to encourage mealtime thrift has been a cheerful affair: with soldiers, factory workers and schoolchildren shown polishing off their plates clean of food.

“But behind the drive is a harsh reality. China does not have enough fresh food to go around — and neither does much of the world.”

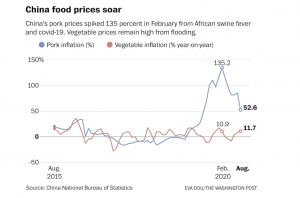

The Post article explained that, “In China, the two foods in the tightest spots are pork and corn, with the nation’s pigs hit hard by African swine fever and much of the year’s corn crop ruined by floods. But fresh foods of all stripes are in short supply, too, due to the coronavirus pandemic and flooding — from eggs, to seafood, to leafy green vegetables.

“Beijing has declared it is not in a food crisis, and says it has enough reserve wheat to help feed its people for a year. Still, China’s leadership has watched uneasily as pork prices soared 135 percent in February, and floods washed away vegetable crops.”

Ms. Dou also noted in the Post article that, “The risks for Beijing extend overseas. China is dependent on the United States this year to bridge its corn shortfall, a position it has sought to avoid for years by stockpiling grain. Beijing’s developing-world allies are facing their worst food insecurity in decades.”

Source: Keith Good, Farm Policy News