Farm Debt and Working Capital Continue to Deteriorate

Last week we reviewed the USDA’s latest farm income projections and noted sector-wide incomes are expected to increase again in 2020. Furthermore, current projections reflect an upward trend in farm income since 2016, with levels above the long-run, inflation-adjusted average. While all this is positive, farm income is only a single measure of the farm economy. The USDA’s projections also include a look at sector-wide financial conditions. This week’s post considers the continued deterioration in farm debt and working capital.

Farm Debt

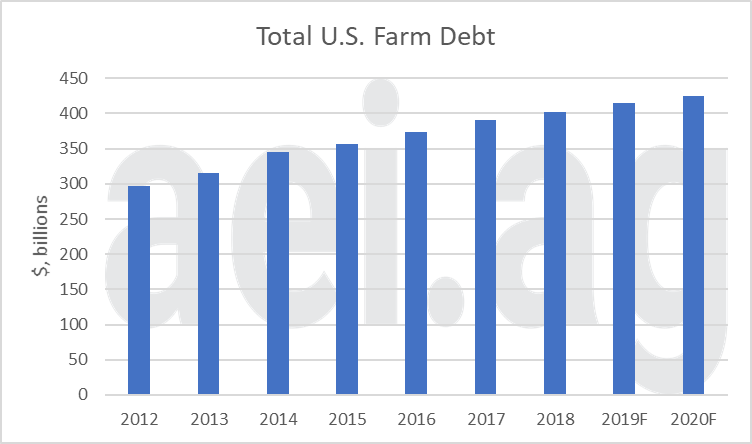

Figure 1 shows total U.S. farm debt over the last ten years. Overall, there has been a steady – if not persistent- uptrend in total farm debt. For 2020, total farm debt is expected to reach $425 billion, up from $300 billion in 2012. Over the last ten years, total farm debt has increased at an average rate of 4% annually [1].

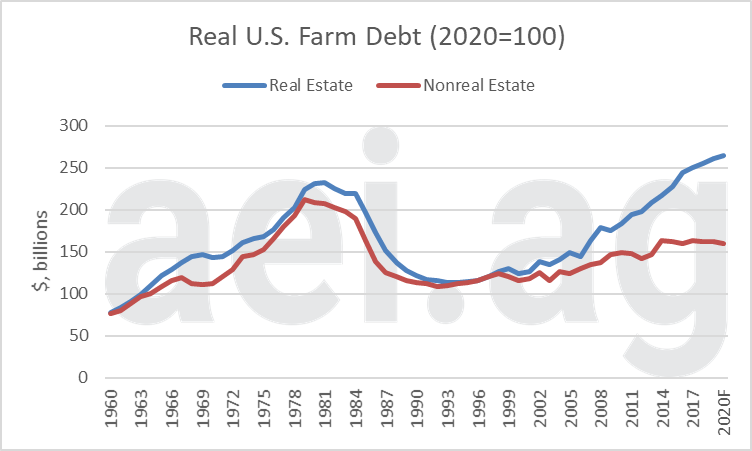

Figure 2 shows real (inflation-adjusted) farm debt – categorized into real estate and nonreal estate – since 1960. There are several insights that can be gleaned from figure 2, but in the context of this week’s post, consider the trends in each category in recent years. Nonreal estate debt has been mostly unchanged. On the other hand, real estate debt has trended sharply higher. In fact, since 2010 total farm debts have increased by 28%; the vast majority of that increase (82%) was real estate debt.

Figure 1. Total U.S. Farm Debt (nominal), 2012-2020F. Data Source: USDA ERS.

Figure 2. Real U.S. Farm Debt, Real Estate (in blue) and Nonreal Estate (in red), 1960-2020F (2020=100). Data Source: USDA ERS.

Working Capital

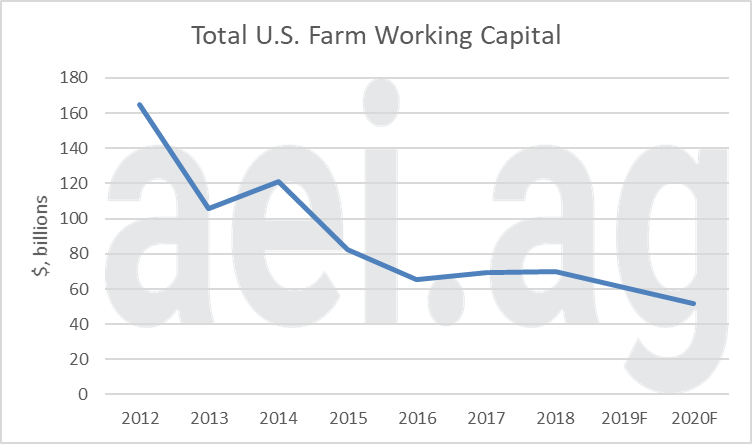

Another measure from the balance sheet is working capital (figure 3). Working capital is often the frontline defense of a farm’s – or any business’s- risk management plan. It is helpful to consider working capital as it gives us an idea of the financial position of the operation. Specifically, working capital measure by taking the operation’s current assets minus current liabilities.

As farm incomes turned lower, so did working capital. In 2012, sector-wide working capital was more than $160 billion. For 2020, the USDA is projecting working capital will fall to $52 billion.

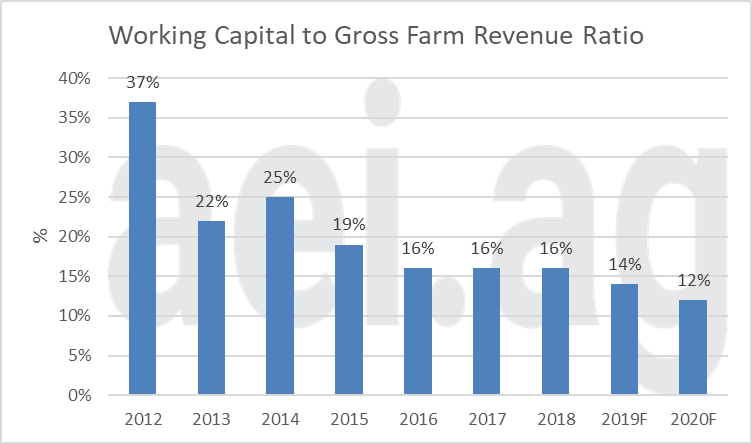

Working capital can also be measured as a percentage of gross revenue. One way of thinking about this ratio is “for every $100 of gross revenue, how much financial cushion (working capital) is there?” Figure 4 shows this measure since 2012. When farm income and working capital were both high, the working capital to gross revenue ratio was 37%. More recently the ratio has been closer to 15%. In 2020, the ratio is expected to reach 12%. For every $100 of projected revenue, the sector will have only $12 of working capital. In other words, many producers will find the current portion of their balance sheet to be very tight in 2020.

A working capital to gross revenue ratio of 12% is pretty low. The University of Minnesota, for instance, classifies a working capital ratio of 10% or lower as “vulnerable” and a ratio above 30% as “strong.”

While one could debate the appropriate level of working capital – especially at the sector-level- it’s the downward trend that is most concerning. When will working capital begin to stabilize?

Figure 3. U.S. Farm Working Capital, 2012-2020F. Data Source: USDA ERS.

Figure 4. Total U.S. Farm Working Capital, 2012- 2020F. Data Source: USDA ERS.

Wrapping it Up

While farm income is trending higher, it’s always tricky to use a single measure to fully summarize the state of the farm economy. The trend towards higher debt and lower working capital point to troubling realities. Producers are utilizing new debt and burning working capital to bridge financial shortcomings. Even though sector-wide incomes- as measured by the USDA- have trended higher, producers rely on that income to satisfy other financial obligations, such as family living expense and debt service.

In short, ever though farm income has trended higher- a welcome, positive sign- the improvements have likely not been enough to satisfy all financial obligations.

Click here to subscribe to AEI’s Weekly Insights email and receive our free, in-depth articles in your inbox every Monday morning.

You can also click here to visit the archive of articles – hundreds of them – and to browse by topic. We hope you will continue the conversation with us on Twitter and Facebook.

[1] Note: this is a nominal rate of increase. A real – or inflation-adjusted- rate of increase would be less.

Source: David Widmar, Agricultural Economic Insights