“Dynamic” Forecast for Feed Grain Trade, and China is the “Primary Driver.”

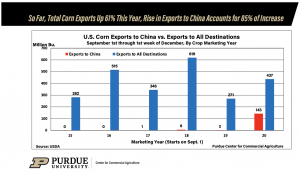

Last week, in its monthly Grain: World Markets and Trade report, the USDA’s Foreign Agricultural Service (FAS) explained that, “Trade data for 2019/20 (October-September) are largely complete. Many countries imported record volumes of corn, despite initial concerns over a potential slowdown in feed use due to COVID-19. For 2020/21, global trade for major feed grains is forecast to grow significantly from a year ago.

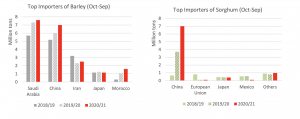

Corn imports are forecast to grow 7 percent from last year’s record, while barley imports are expected to grow 6 percent. Sorghum imports are estimated up 53 percent.

FAS noted that, “The primary driver behind the forecast growth is China. Domestic corn prices in China have been rising throughout calendar year 2020 reaching $378 per ton last month, the highest since July 2015. Since July, the country has been active in securing corn and corn substitutes (sorghum, barley, and field peas) to satisfy growing demand for feed in its animal sector.”

The FAS report pointed out that, “China’s corn imports are currently forecast to more than double from last year.”

“Barley imports are forecast to be larger than a year ago as China steps up purchases from Canada, France, and Ukraine, while imposing antidumping and countervailing duties on barley from Australia. For sorghum, global trade is forecast higher on China’s growing need for supplies from the United States and to a lesser extent Argentina,” the report said.

FAS added that, “With domestic corn prices continuing to run at near-record levels, China is expected to be a key player in global trade for corn as well as corn substitutes. Given China’s outsized impact on global commodity markets and as its import needs unfold into 2020/21, coarse grain trade is expected to be dynamic.”

Also last week, Bloomberg writers Michael Hirtzer, Kim Chipman, and Megan Durisin reported that, “[The U.S. Department of Agriculture, in its monthly WASDE report Thursday], did raise its outlook for China’s corn imports to 16.5 million tons, up from 13 million tons in the November forecast but still trailing an unofficial USDA attache estimate for 22 million. Likewise, more Chinese imports of barley and sorghum mean the Asian country is on track to bring in a record amount of feed-grain supplies.”

With respect to Chinese pork production, a key feed grain import demand variable, Bloomberg News reported last week that, “If farmers can control African swine fever over the winter, China’s own production may increase at least 10% from this year’s levels, with a full recovery in pig numbers due in 2023 or 2024, said [Pan Chenjun, a senior livestock analyst with Rabobank]. Record breeding profits have triggered an aggressive expansion in farms large and small this year, although domestic pork prices may remain elevated in 2021, she said.”

And in news on Chinese domestic corn production, Reuters writer Dominique Patton reported last week that, “China produced 260.67 million tonnes of corn in 2020, the National Bureau of Statistics said on Thursday, barely changed from last year despite weather damage before the harvest in the world’s second biggest producer.”

Nonetheless, the article stated that, “Some analysts, however, doubted the corn numbers.

“‘It seems too high. The sown area is pretty much exactly the same as last year and so is the yield. But the northeast was hit with three typhoons in a row,’ said Darin Friedrichs, a senior Asia commodity analyst at StoneX.”

“Output was probably down about 5 million tonnes, estimated Meng Jinhui, analyst at Shengda Futures, because of the challenging weather conditions during the year,” the Reuters article said.

Source: Keith Good, Farm Policy News