Coronavirus Increases Challenge of a Demand Bounce, and Phase One Purchase Targets

Bloomberg writers Lydia Mulvany and Michael Hirtzer reported last week that, “In times of economic woe, one of the first luxuries to go is beef. That old adage is so far proving to be true as the global coronavirus outbreak dents demand.

“A key U.S. government report Tuesday lowered forecasts for American exports of the meat amid weaker demand, while an industry group a day earlier said weakness in red meat shipments due to coronavirus could show up soon in trade data. Asian nations including China, South Korea and Japan, which are top importers of beef, have seen a slowdown in restaurant traffic. That’s bad news for premium cuts of American steak.”

The Bloomberg article explained that, “U.S. producers have been expanding red meat and poultry output for years in anticipation of record overseas demand for protein, especially from Asia. The expectations for shipments swelled further ever since African swine fever started killing off hundreds of million of hogs in the region. But trade wars and now the coronavirus crisis has delayed any benefits to American farmers, who instead are seeing a meat glut continue to pile up.”

More specifically on the impacts the virus is having on demand, and Phase One trade agreement pledges from China, Wall Street Journal writer Nathaniel Taplin reported last week that, “Under siege from the novel coronavirus, China’s economy is poised to contract in the first quarter and post sharply lower growth this year. Under siege from the Trump administration in 2019, Beijing had already agreed to boost purchases of U.S. goods by nearly $80 billion in 2020 over 2017 levels.

“Are these two realities compatible? The Trump administration seems to think so. In late February, U.S. Trade Representative Robert Lighthizer and Agriculture Secretary Sonny Perdue said they still expect China to live up to the letter of the recently signed phase one trade deal.

“Investors should brace themselves for disappointment.”

Mr. Taplin stated that, “Achieving the ambitious purchase commitments in the deal always seemed like a stretch, but the huge hit to corporate cash flow from the coronavirus—up to four trillion yuan ($577 billion) by some estimates—may make it next to impossible.”

And William Mauldin and Alex Leary reported last week at The Wall Street Journal Online that, “‘The ‘phase one’ agreement leaves on the table more significant, structural commitments for a future ‘phase two’ or even ‘phase three’ agreement,’ said Rep. Richard Neal, the chairman of the House committee that oversees trade, in a hearing on China trade. ‘Now, because of the outbreak of the coronavirus in China, purchase commitments and other promises made by China as part of this agreement may not even happen.’”

Des Moines Register writer Donnelle Eller reported last week that, “The coronavirus outbreak that’s roiling the global economy is suppressing a boost in demand that farmers hoped to see after the United States reached a trade agreement with China, economists and others say.”

‘It always looked like it was going to be challenging for China to meet their targets, but now it’s even more challenging,’ said Dermot Hayes, an Iowa State University economist.

On the other hand, a press release last week from USDA stated that, “U.S. Secretary of Agriculture Sonny Perdue announced today that China has continued its progress in implementing the U.S.-China Phase One Economic and Trade Agreement and has taken several additional actions to realize its agriculture-related commitments. The agreement entered into force on February 14, 2020, and the actions announced today build upon the measures announced on February 25.”

Also, Bloomberg writer Jeff Black late last week that, “Bloomberg Economics estimates that the Chinese economy was operating at 80% to 85% of normal capacity as of Friday.”

And Reuters writer Dominique Patton reported on Thursday that, “China has drawn up food safety standards on residue limits of growth hormones in beef, a move seen as a further step towards opening up its market to American imports of the meat.”

But the article noted that, “Demand for imported beef in China this year is expected to take a significant hit from measures implemented to curb the coronavirus epidemic, [Justin Sherrard, global strategist of animal protein at Dutch bank Rabobank] said.”

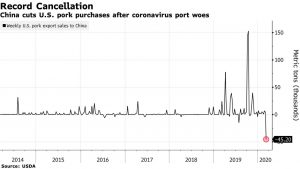

On Thursday, Bloomberg writer Michael Hirtzer reported that, “Chinese buyers canceled a record amount of U.S. pork last week after imports were piling up at the Asian giant’s ports amid the coronavirus outbreak.

“China cut purchases of 45,200 metric tons of pork, according to weekly data from the U.S. Department of Agriculture. That’s the most ever in data that began in 2010. The cancellations were partially offset by sales to Canada, Mexico and Japan, resulting in an overall net reduction of 26,600 tons.

“The loss cast further doubt on a demand bounce for American meat in China, even as the country began granting tariff waivers on U.S. goods as part of the trade deal signed in Washington in January.”

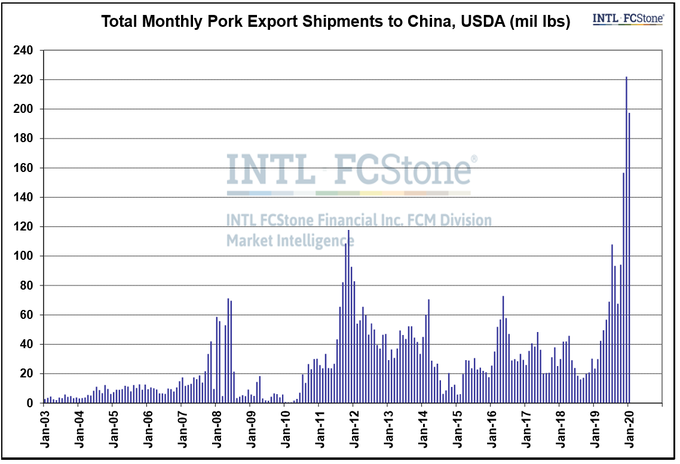

Arlan Suderman@ArlanFF101

We’ve seen several months of the strong #pork shipments to China that we’ve been waiting for, but have some surplus to work through. #oatt

3:37 PM – Mar 10, 2020Mr. Hirtzer added, “Still, there were hopes of a pickup in U.S. pork sales to China. Activity was resuming as the spread of the virus slowed. While China canceled some pork orders, USDA data also showed 16,100 tons in new shipments to the country. Meanwhile, Chinese buyers ordered supplies of U.S. sorghum and cotton, and canceled 90,000 tons of soybeans.”

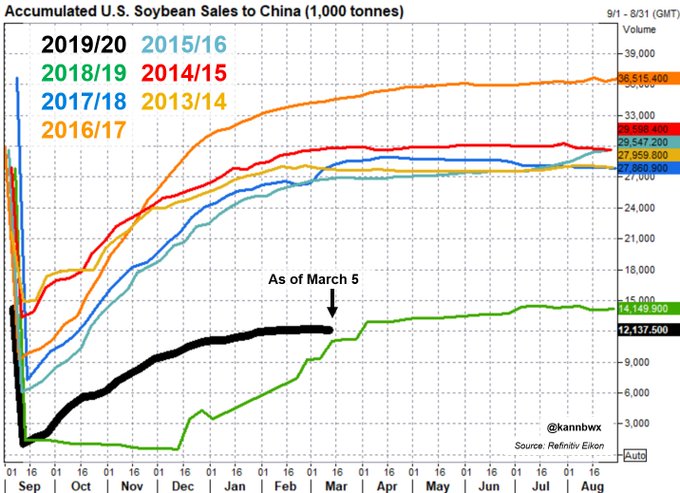

Karen Braun

✔@kannbwx

Should be noted that #China cancelled 90,281 t of U.S. #soybeans last week, its first cancel since early Sept. U.S. bean sales to China have practically ground to a halt & USDA’s export sales report showed there was only one cargo of outstanding sales left to ship as of March 5.

More narrowly regarding soybeans, Reuters columnist Karen Braun explained last week that, “U.S. soybean shipments have rebounded from last year’s trade war-fueled lull, but recent volumes and sales are well off normal levels and February exports were alarmingly low, raising concerns for the rest of the 2019-20 season.”

Ms. Braun noted that, “China’s recent lack of interest has been seriously concerning, as February purchases from the United States likely totaled less than 300,000 tonnes. But China is likely the only buyer that can prop up U.S. bean sales as much as is necessary over the next several months to sustain current export expectations.”

“Brazil’s enormous soybean harvest, price advantage, and heavy shipping lineup are also of concern for U.S. soybean exporters, as the top supplier is poised to supply China with plenty of soybeans in the coming months,” the Reuters column said.

Source: Keith Good, Farm Policy News