China’s Grain Buying Is “Rocking the Global Market”

Late last week, Reuters writers Hallie Gu, Maximilian Heath, and Naveen Thukral reported that, “Chinese feed producers, pig farmers and traders are reshaping the global grain market as they scour the world for supplies amid a domestic shortfall that sent local corn prices to record highs and is expected to fuel global food inflation in 2021.

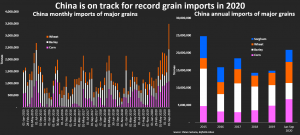

“The country’s buying has put it on a trajectory to emerge as the top grain buyer by far this season, shattering previous purchase records and marking a clear break from China’s history as a relatively self-sufficient player in grain markets.

“That purchasing, and problems in other key producing countries, has helped lift corn, wheat and barley prices worldwide – potentially sending shocks through the grain-reliant dairy and meat sectors in coming months, analysts and traders said.”

China’s grain buying has accelerated since May as Beijing burned through once-huge stockpiles and as extreme weather damaged this year’s corn crop.

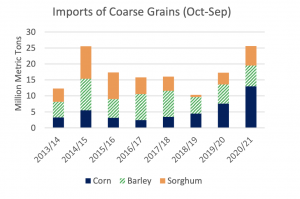

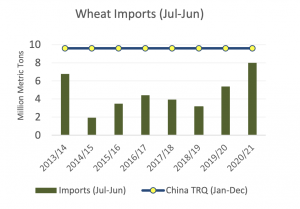

The Reuters article noted that, “About 15 million tonnes of barley and sorghum imports are expected in the new marketing year, according to two analysts. Wheat imports in 2020-21 are expected to reach 9 million tonnes, a record, according to a state-owned trader.

“China’s voracious appetite is rocking the global market.”

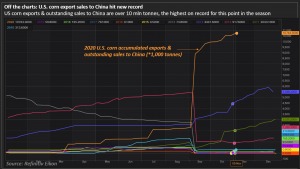

Gu, Heath and Thukral added that, “Additional U.S. corn purchases are also expected.”

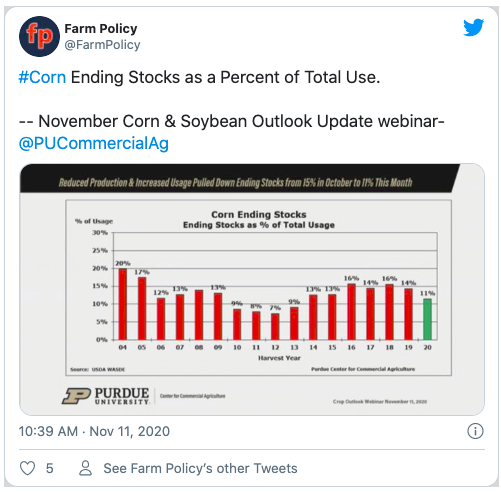

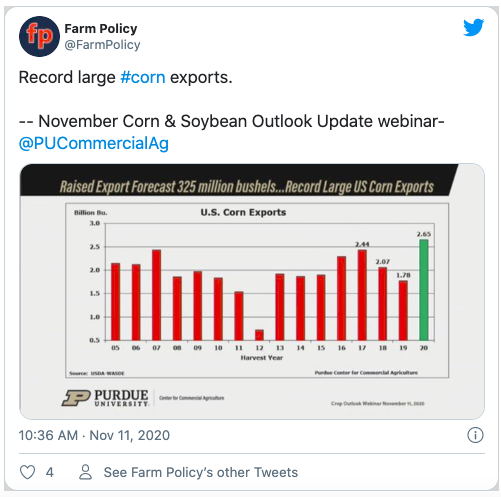

And Reuters writer Mark Weinraub reported last week that, “In its monthly World Agricultural Supply and Demand Estimates report, the U.S. Agriculture Department pegged 2020/21 U.S. corn ending stocks at 1.702 billion bushels and soybean ending stocks at 190 million bushels. The U.S. corn harvest was seen at 14.507 billion bushels and the soybean harvest at 4.170 billion bushels.

“Rising export demand from China and South Korea also pressured corn’s balance sheet. USDA boosted its outlook for U.S. corn exports by 325 million bushels to 2.650 billion.

“It raised its 2020/21 corn import projections for China to 13 million tonnes from its previous outlook of 7 million tonnes.”

The article noted that, “Earlier this month, a USDA attache report from Beijing said it expected China to import 22 million tonnes of corn, amid a surge in animal feed demand and after storms and drought damage tightened domestic supplies.”

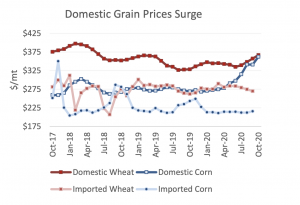

Also last week, the USDA’s Foreign Agricultural Service (FAS) indicated in its Grain: World Markets and Trade report that, “China’s imports of coarse grains for 2020/21 (Oct-Sep) are forecast higher this month, mirroring the level seen in 2014/15 when imports spiked due to strong prices in the domestic market. The rise for 2020/21 is supported by strong recovery in the swine sector, which has been driving feed demand higher. Corn prices in the domestic market have rallied since February, and in October, the national price averaged around $362 per ton, the highest since August 2015.”

The FAS update stated that, “Greater imports are primarily driven by corn. The surge in corn imports is partly based on China Customs Statistics and U.S. Grain Inspections data through early November, which indicate that imports will far exceed the tariff-rate quota (TRQ) level of 7.2 million tons in calendar year 2020. There have been no public statements that would indicate that additional quota has been allocated by the National Development Reform Commission, the authority governing the TRQs.”

With respect to wheat, FAS stated that, “China wheat imports of 8.0 million tons in 2020/21 are forecast at their highest level in 25 years as State Trading Enterprises are helping bolster domestic stocks and taking advantage of competitively priced foreign supplies.

“The demand for feed-quality wheat has surged because of significant inflation in the domestic corn market,” FAS said.

Source: Keith Good, Farm Policy News