China Has Purchased 71% of Its Phase One Target and Could Issue More Corn Import Permits

A news release from USDA on Friday stated that, “The Office of the U.S. Trade Representative (USTR) and [USDA] today issued a report highlighting the progress made to date in implementing the agricultural provisions in the U.S.-China Phase One Economic and Trade Agreement, which is delivering historic results for American agriculture.

“Since the Agreement entered into force, the United States and China have addressed a multitude of structural barriers in China that had been impeding exports of U.S. food and agricultural products. To date, China has implemented at least 50 of the 57 technical commitments under the Phase One Agreement. These structural changes will benefit American farmers for decades to come.

China also has substantially ramped up its purchases of U.S. agricultural products. To date, China has purchased over $23 billion in agricultural products, approximately 71% of its target under the Phase One Agreement.

Friday’s update added that, “Highlights outlined in the report include:

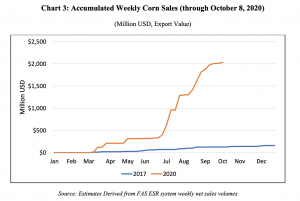

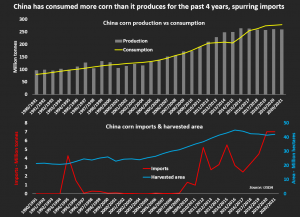

- Corn: Outstanding sales of U.S. corn to China are at an all-time high of 8.7 million tons.

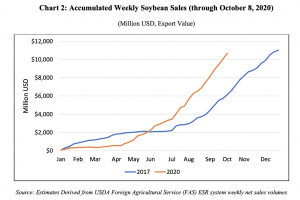

- Soybeans: U.S. soybeans sales for marketing year 2021 are off to the strongest start in history, with outstanding sales to China double 2017 levels.

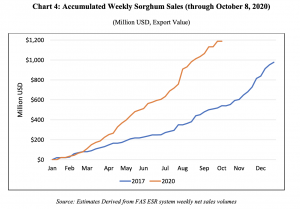

- Sorghum: U.S. exports of sorghum to China from January to August 2020 totaled $617 million, up from $561 million for the same period in 2017.

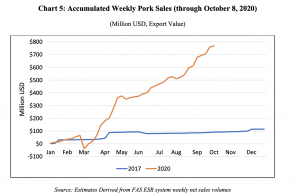

- Pork: U.S. pork exports to China hit an all-time record in just the first five months of 2020.

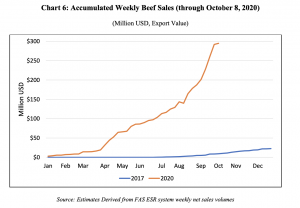

- Beef: U.S. beef and beef products exports to China through August 2020 are already more than triple the total for 2017.

Bloomberg’s Mike Dorning and Isis Almeida reported on Friday that, “The Trump administration says China has met 71% of its farm-good purchases under the phase one trade deal. Whether that’s the most accurate way to measure the progress is still up for debate.”

The article noted that, “The USTR was never clear in the agreement about how it would calculate progress, but the text of the deal calls for product to be purchased and imported into China in 2020. If travel time is considered — as much as a month from parts of the U.S. to China — that may also rule out most of the December shipments.

“‘The agreement explicitly calls for the goods to be imported into China, so on its face, compliance would seem to require not just an outstanding sale, but also delivery within the calendar year,’ said Seth Meyer, associate director at the University of Missouri’s Food & Agricultural Policy Research Institute and former chairman of the USDA’s World Agricultural Outlook Board.”

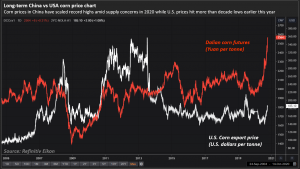

Meanwhile, Reuters writers Naveen Thukral and Hallie Gu reported on Friday that, “China’s government is discussing permits for millions of tonnes of additional corn imports over the next year, three industry sources told Reuters, amid a surge in animal feed demand and after storms and drought damage tightened domestic supplies.

A round of new import orders from China would make it the world’s top importer of corn for the first time and likely drive up global prices of corn and other grains. That would amplify food inflation caused by disruptions to global supply chains due to the coronavirus pandemic.

The Reuters article explained that, “Two China-based sources and a Singapore-based trader with knowledge of import discussions said Beijing was considering issuing more lower-tariff quotas for buyers to ease the domestic shortage. These quotas encourage imports by exempting shipments from most of the 65% tariffs that would otherwise be levied by Chinese customs.”

Thukral and Gu pointed out that, “Beijing routinely issues 7.2 million tonnes in annual low-tariff quotas for corn imports, and meets most of its 280 million tonnes of annual demand through domestic crops. China has never before used its full annual quota.

“Analysts have estimated it may need more than four times that quota, or 30 million tonnes, in the 2020-2021 October to September crop year.”

The Reuters article added that, “Even before further additional quotas are awarded, Chinese importers have ordered more than double the annual allowance. They have booked around 12 million tonnes of corn imports from the United States and around 5 million tonnes from elsewhere including Ukraine for the crop year, according to a Singapore-based international trading source and two other people with knowledge of the deals.

“That would put China just behind Mexico, the world’s largest importer. Mexico is forecast to import 18.3 million tonnes, according to United States Department of Agriculture (USDA) estimates.”

And more specifically on corn demand variables relating to animal feed in China, Reuters News reported on Wednesday that, “[Chinese] pig producers have built 12,500 new large-scale pig farms in the first three quarters of the year and restarted more than 13,000 empty farms, Wei Baigang, the head of the development and planning division of the ministry, said at the briefing.

“Wei said the recovery of the hog herd had been ‘better than expected‘ after African swine fever wiped out at least 40% of China’s pigs in 2019.”

“Through September, pig stocks were 370 million, or 84% of the level in 2017, before the disease hit, said Wei, while breeding sows reached 38.22 million, or 86% of 2017 levels,” the Reuters article said.

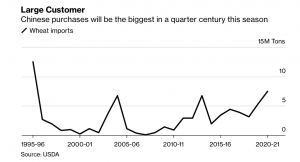

With respect to Chinese wheat purchases, Bloomberg writers Anatoly Medetsky and Megan Durisin reported last week that, “China is set to buy the most wheat in a quarter century and has already booked large amounts from the U.S. and France.”

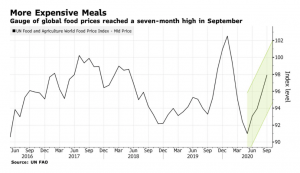

More broadly, the Bloomberg article stated that, “Rising grain costs are already feeding through to pricier meals, with a United Nations’ gauge of food prices at a seven-month high. That could further hurt economies battered by the pandemic and put more pressure on nations suffering from hunger crises.”

Also last week, Bloomberg writers Fabiana Batista, Agnieszka de Sousa, and Mai Ngoc Chau reported that,

Wild weather is wreaking havoc on crops around the world, sending their prices skyrocketing.

“On wheat farms in the U.S. and Russia, it’s a drought that’s ruining harvests. The soybean fields of Brazil are bone dry too, touched by little more than the occasional shower. In Vietnam, Malaysia and Indonesia, the problem is the exact opposite. Torrential downpours are causing flooding in rice fields and stands of oil palm trees.

“The sudden emergence of these supply strains is a big blow to a global economy that has been struggling to regain its footing after the shock of the Covid-19 lockdowns. As prices soar on everything from sugar to cooking oil, millions of working-class families that had already been forced to scale back food purchases in the pandemic are being thrust deeper into financial distress.”

Source: Keith Good, Farm Policy News