China Could Become Largest Corn Importer, While Soybean Variables Come Into Focus

Bloomberg News reported earlier this week that, “The corn harvest in [China] the world’s top producer after the U.S. is being closely watched as demand for hog and poultry feed expands and state reserves dwindle, pushing local prices to the highest in five years. Purchases from the U.S. and Ukraine already exceed 10 million tons, and they could hit 20 million tons if U.S. prices stay competitive, said Feng Lichen, chief analyst with portal www.yumi.com.cn. That would make the country the world’s largest importer.

“The buying also helps meet commitments under the U.S. trade deal. Imports that have been mostly ordered by state-owned companies are sold at a discount to local prices to benefit animal-feed mills in the south, said Feng.

The surge in shipments has sparked speculation that China could become chronically dependent on the world market for large supplies, as happened with soybeans, where it accounts for more than 60% of global imports.

“Chinese buying has helped push Chicago corn futures to the highest level since March.”

Meanwhile, Reuters writer Mark Weinraub reported this week that, “Chinese buyers booked deals to buy 664,000 tonnes of soybeans, the largest daily total since July 22, for delivery in the 2020/21 marketing year, the U.S. Agriculture Department said on Tuesday.

“The sales were the latest in a string of large U.S. farm commodity purchases by China, which vowed to import record amounts of U.S. agricultural goods this year as part of a Phase 1 trade deal signed in January.”

The Reuters article added that, “China has been ramping up its U.S. corn imports, as the country faces its first real corn shortfall of corn in years. A sharp price surge in corn – critical for China’s mammoth hog, dairy and poultry sectors – is the latest in a series of ructions that include a devastating pig disease, pandemic-driven upsets for international suppliers and warnings of a growing food supply gap.”

Additional announcements regarding U.S. soybeans to China were posted by USDA on Wednesday, Thursday and Friday.

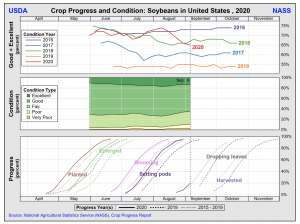

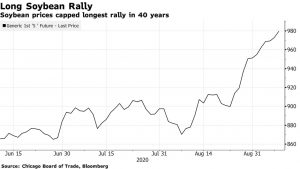

And Bloomberg writer Elizabeth Elkin reported on Wednesday that, “Soybean futures capped the longest rally in 40 years after top buyer China stepped up purchases and the outlook for this year’s U.S. crop deteriorated.

“Futures traded in Chicago rose for a 12th consecutive session, the longest rally for a most-active contract since 1980. China stepped up purchases in recent months to meet demand from a hog industry that’s recovering faster than analysts expected. American sales from the new crop to the Asian nation are running at the fastest pace in seven years, U.S. Department of Agriculture data show.”

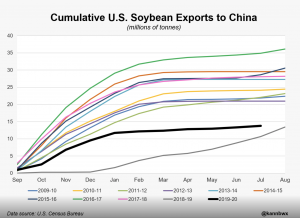

Nonetheless, Reuters columnist Karen Braun pointed out this week that, “From mid-February through August, the United States exported about $1.5 billion worth of soybeans to China, down 30% on the five-year average. If counting from January, the total is about $2.4 billion, down 40%. That means 2020 is nowhere close to on pace to fulfill half of the Phase 1 target with soybeans.

“Calendar year 2020 has been dismal for U.S. soy shipments to China. According to data published by the U.S. Census Bureau on Thursday, the January-July volume totaled just 4.2 million tonnes, the smallest since 2004.”

Also, a report from USDA’s Foreign Agricultural Service (“China: Oilseeds and Products Update“) pointed out earlier this month that, “Marketing year (MY) 20/21 soybean imports are forecast at 95 MMT, an increase of 4 MMT compared to the June update based on larger stocks and growing soybean meal feed use for the expanding swine and poultry sectors. Likewise, MY19/20 soybean imports are estimated at 95 MMT, up by 5 MMT over the last report based on trade data, including a third straight month of record imports from Brazil and total imports of about 79 MMT during the first 10 months of the marketing year.”

Also with respect to Chinese demand for agricultural commodities, Bloomberg News reported this week that, “China’s next five-year plan beginning in 2021 will call for increases to its mammoth state reserves of crude, strategic metals and farm goods, said officials familiar with the discussions.

“Beijing is keen to heed the lessons of the coronavirus crisis and deteriorating relations with the U.S. and its allies, according to the officials, who participated in the drafting of the plan. That means ensuring the nation’s secretive stockpiles, almost certainly among the world’s largest, are plentiful enough to withstand supply disruptions that could cripple its economy, the officials said, asking not to be identified because the matter is sensitive.”

The Bloomberg article noted that, “Assuaging China’s anxieties over energy and food security in particular will be a focus of the new buying program, the officials said.”

Source: Keith Good, Farm Policy News