As Importer’s Need for Corn and Soybeans Seen Rising, Few Countries Currently Competing with U.S. for Export Demand

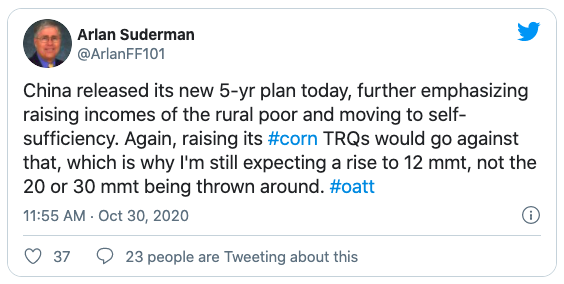

Bloomberg News reported last week that, “China’s corn imports could more than double to 17 million tons in 2020-2021 from a year earlier on prospects for a smaller domestic harvest and a recovery in demand for hog feed, according to the head of the logistics information department at COFCO Trading Co.

“The increase in imports would also be to meet commitments under the U.S. trade deal, Wang Baichao said during an online seminar on Tuesday. Imports were 7.6 million tons in 2019-2020, he said. China has already booked more than 10 million tons of U.S. corn for 2020-2021, including 8.8 million tons which have not been shipped, according to the U.S. Department of Agriculture.”

The Bloomberg article explained that, “Because of a near record price gap between domestic and Chicago corn prices, imports of sorghum and barley, which are used to replace corn and are not subject to quotas, are also likely to expand more than expected, Wang said. Overseas purchases of sorghum totaled 3.7 million tons in 2019-2020, while barley imports were almost 6 million tons.”

And on Friday, a Market Intel update from the American Farm Bureau Federation stated that,

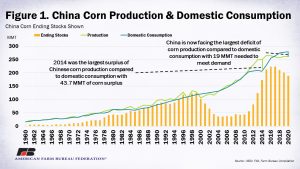

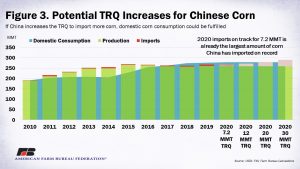

China is on pace to import its largest amount of corn on record.

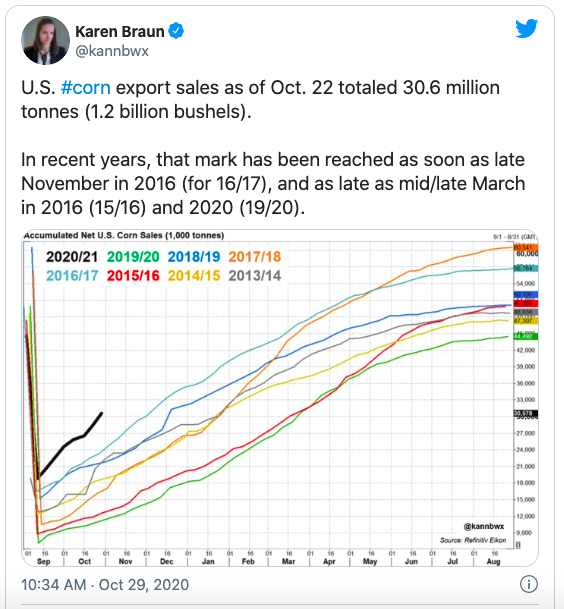

“With tightening supplies from weather impacts on production and rising demand as the country recovers from African Swine Fever, the pace at which China still needs corn is rising. Domestic corn prices are climbing to new highs, making global producers like the U.S. attractive alternatives for less expensive corn. There is an additional incentive to purchase U.S. corn to help meet commitments established in the Phase 1 agreements. As of October 22, accumulated exports of corn totaled 1.9 MMT, outstanding sales totaled 8.7 MMT, and total commitments stand at 10.6 MMT.

“If China decides to raise its low-tariff-rate quota on corn imports, it will import its largest amount on record. China could still import more corn above the TRQ but will be required to pay tariffs of up to 65% of the purchase price.

“As more purchases are fulfilled, USDA will also need to increase its estimate of Chinese imports for the World Agricultural Supply and Demand Estimates, changing the U.S. and global landscape of new crop year corn supply, demand and prices.”

Meanwhile, Reuters writer Mark Weinraub reported on Thursday that, “Mexican grains buyers booked deals to buy their largest volume of corn from the United States since last December, the U.S. Agriculture Department said Thursday, a development that could point to growing import demand from its southern neighbor.

“The sale for 1.433 million tonnes of U.S. corn occurred after Mexico’s most productive farmers warned they may not be able to meet demand with domestic supplies after deep government spending cuts.”

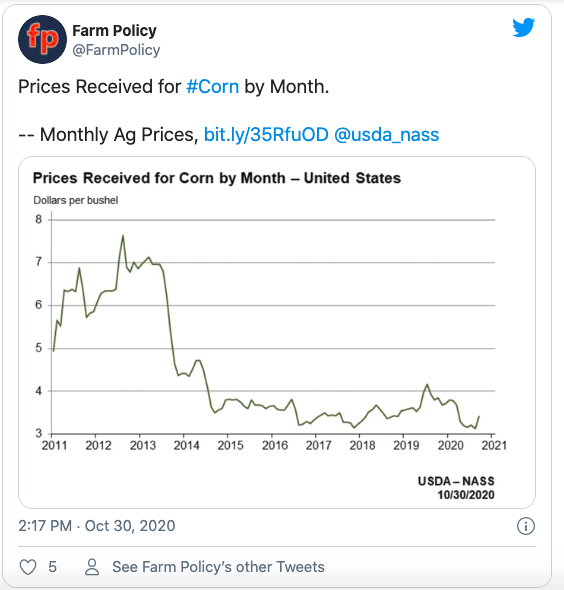

The Reuters article noted that, “The sale came as corn prices hover around their highest since August 2019 and China discusses importing millions of additional tonnes of corn over the next year.”

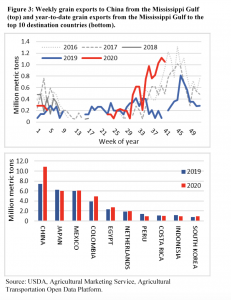

On Thursday, the weekly Grain Transportation Report, from USDA’s Agricultural Marketing Service (AMS), stated that, “As a major mode for bringing grain to market, barges move roughly half of all grain destined for export, including about 60 percent of exported corn and 50 percent of exported soybeans. Although flat at the start of the year, grain traffic on the Mississippi River has risen considerably in the past 6 weeks.”

The AMS report pointed out that, “In recent weeks, exports to China out of the Mississippi Gulf have grown substantially.”

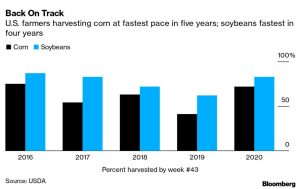

Also last week, Bloomberg writer Michael Hirtzer reported that, “Harvests of America’s biggest crops are advancing at the fastest pace in years, replenishing coffers for shippers at a time when few other countries are competing with the U.S. for export demand.

“Importers such as China and Mexico have been gobbling up large amounts of U.S. agricultural goods.”

Mr. Hirtzer indicated that, “The American corn harvest was 72% complete as of Oct. 25, above the year-ago pace of 38% and the quickest in five years for the country’s most widely grown crop, according to U.S. Department of Agriculture data. Soybeans, the second-biggest crop, were 83% harvested, versus 57% a year ago and the fastest in four years.”

And more broadly with respect to corn and soybean exports, Reuters writer Tom Polansek reported last week that, “COVID-19 outbreaks are increasing governments’ food-security concerns, and importers need U.S. corn and soybeans for the first time in a long time to meet demand, Archer Daniels Midland Chief Executive Officer Juan Luciano said on Friday.”

‘For the very first time in a long time, the world needs the U.S. supply for both soybeans and corn,’ Luciano said.

“China’s government is discussing permits for millions of tonnes of additional corn imports over the next year, Reuters has reported, amid a surge in animal-feed demand,” the Reuters article added.

Source: Keith Good, Farm Policy News