As COVID-19 Slows Meat Processing, Livestock Producers May Face Tough Choices

Bloomberg writers Michael Hirtzer and Isis Almeida reported this week that, “First, it was just one plant shutting down. But now, it’s at least seven major U.S. meat facilities that have seen halts in the space of a few weeks. And all those voices previously assuring Americans that supplies would be fine now sound like a chorus of concern over shortages.

“There’s been an avalanche of news in just 24 hours. Tyson Foods Inc. shut two of its key pork plants. Case counts continued to mount, including in Canada, where industry groups are saying they’ll probably hold back some of what’s usually exported to the U.S. Meanwhile, the head of JBS SA, the world’s top meat producer, warned of shortfalls.”

Front Page today’s @USATODAY: “#Meat Plant Infections Could Rise,” https://bit.ly/3aALua5 (#COVID19).

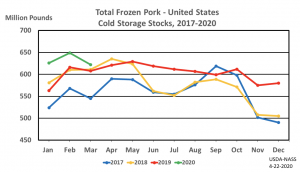

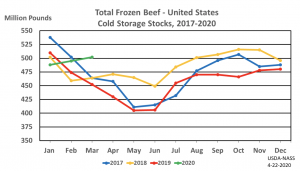

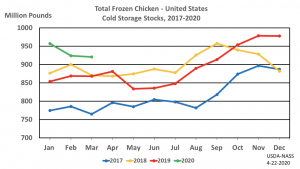

The Bloomberg article pointed out that, “The U.S. government also pushed out its monthly figures on frozen food inventories, which stood in sharp relief against the backdrop of closures. One figure in particular might give even the naysayers pause.

“Combined pork, beef and poultry supplies in cold-storage facilities now stand equal to roughly two weeks of total American meat production. With most plant shutdowns lasting about 14 days for safety reasons, that raises the potential for deficits.”

The Bloomberg writers explained that,

Meat prices are surging on the disruptions. But with slaughterhouses closing, farmers don’t have a market for their animals. That’s causing hog futures to drop, potentially creating a situation where pigs get euthanized and buried as supplies back up. Meanwhile, retail costs may rise as grocery stores mandate rationing on pork chops.

Hirtzer and Almeida added that, “Shutdowns for slaughtering plants are cascading through meat supply chains and causing weird dislocations for prices — finished products are surging, while farmers are getting paid much less for animals.

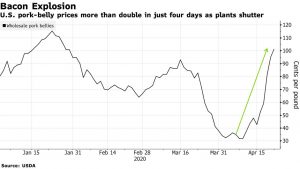

“Prices for pork bellies, the cut that’s turned into bacon, more than doubled in just the four days through Tuesday on supply concerns. With so many fewer hogs moving through slaughter, Smithfield Foods had to shutter facilities in Wisconsin and Missouri that turn pork into products like bacon and sausage.

“Meanwhile, prices for the hogs themselves are plummeting. There are way more pigs than can be processed right now, so animals are backing up on farms. Hog futures traded in Chicago are down about 21% in April.”

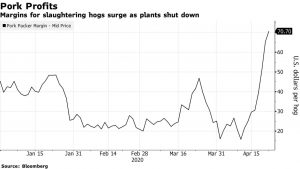

The Bloomberg article noted that, “That means sky-rocketing margins for meatpackers — the folks who do the slaughtering and turn pigs into chops and bacon. They’re paying less to farmers to get the animals, and then getting higher prices for their finished products. Pork margins are up about 340% since April 1, according to data from HedgersEdge.”

Also this week, Reuters writer Tom Polansek reported that, “Tyson Foods Inc is shuttering two pork processing plants, including its largest in the United States, to contain the spread of the coronavirus, further tightening meat supplies after other major slaughterhouse shutdowns.”

The article added that, “Tyson Foods, the largest U.S. meat supplier, said it will indefinitely suspend operations at its largest pork plant in Waterloo, Iowa, after operating at reduced capacity.

“Plant employees tested positive for the virus, and others stayed home out of fear of becoming infected. The facility slaughters about 19,500 hogs a day, or about 5% of total U.S. pork production, according to industry data.

“Tyson also plans to close a pork processing facility in Logansport, Indiana, while its more than 2,200 workers at the plant undergo testing for COVID-19.”

Mr. Polansek noted that, “When the Logansport facility closes, slaughterhouses that account for 19% of pork production in the United States will be shut.”

Tyson Foods president: #Coronavirus‘ impact on supply chains can’t be measured | https://video.foxbusiness.com/v/6151050583001/ …

FOX Business @FoxBusiness

Meanwhile, Donnelle Eller reported on the front page of Wednesday’s Des Moines Register that, “Iowa livestock producers face tumbling prices after hundreds of meatpacking workers have tested positive for COVID-19, resulting in Midwest processing plants significantly slowing production or closing.

“The situation could turn tragic for pork producers, who face the possibility of euthanizing thousands of animals backed up on farms across the state.”

The Register article noted that, “Pork processing capacity has shrunk by about 25%, crushing hog prices, which have tumbled about 50% since January. That’s especially troubling in Iowa, the nation’s largest pork producer, with nearly 25 million pigs in confinements across the state.

U.S. Sen. Chuck Grassley said Tuesday he’s heard estimates that the country has about 100,000 pigs that should be slaughtered each day but aren’t. ‘Apply that over 10 days, and with a million pigs, you’ve got a big problem,’ the Iowa Republican said in a call with reporters.

“Cattle producers face big losses and tough choices, too, but have more flexibility to hold animals on their farms longer than pork producers do.”

Wednesday’s article added that, “Across the country, dairy farmers are dumping milk and chicken producers are destroying eggs. Lost meatpacking capacity has contributed to falling prices for cattle producers, as well. And corn and soybean prices are below the cost of production at the same time as farmers look to plant crops.

“Iowa grain, livestock and ethanol producers could lose an estimated $6.3 billion this year because of the coronavirus, a new Iowa State University study shows.”

Source: Keith Good, Farm Policy News