African Swine Fever Continuing to Impact U.S. Pork Exports and World Protein Markets

Earlier this month, in its monthly Livestock, Dairy and Poultry Outlook, USDA’s Economic Research Service (ERS) explained that, “U.S. trade data through September indicate that in the first three quarters of 2019 total exports of red meat and poultry increased 1.1 percent. However, driven by a large increase in expected fourth-quarter shipments, exports for the year are forecast to increase more than 3 percent compared with 2018, followed by an increase in 2020 of about 7 percent.”

Livestock, Dairy, and Poultry Outlook, LDP-M-305, U.S. Department of Agriculture, Economic Research Service, November 15, 2019.

More specifically, ERS stated that, “Large year-over-year pork exports—about 11 percent in 2019 and more than 12 percent in 2020—are forecast, due largely to likely increased import demand from African Swine Disease (ASF)-stricken countries in Asia.”

With respect to September, The Outlook noted that, “September pork exports were 465 million pounds, 7.6 percent higher than a year ago. Shipments to most of the ‘usual’ large buyers were lower: Mexico (-3.7 percent), Japan (-6.1 percent), Canada (-1.4 percent), and South Korea (-9.9 percent).

Exports to China\Hong Kong─more than triple last year’s volume—were largely responsible for holding the September total above exports of a year ago.

“Shipments to the 10 largest buyers in September are summarized below, along with their respective shares of September exports.”

Livestock, Dairy, and Poultry Outlook, LDP-M-305, U.S. Department of Agriculture, Economic Research Service, November 15, 2019.

“Strong year-over-year increases in U.S. exports to China\Hong Kong are the result of continued liquidation of Chinese hog inventories, reduced pork production, and skyrocketing pork prices, brought about by African Swine Fever (ASF).”

Additionally, ERS pointed out that, “USDA forecasts that Chinese pork production will decline by 14 percent this year compared with 2018. By the end of October, Chinese pork prices had responded to reduced pork supplies by more than doubling, year over year. October pork prices averaged more than 60 percent higher than prices at the beginning of August (week 32 in the figure below).”

Livestock, Dairy, and Poultry Outlook, LDP-M-305, U.S. Department of Agriculture, Economic Research Service, November 15, 2019.

“China has stepped up pork imports in response to reduced pork production. USDA forecasts that China’s 2019 imports will increase almost 67 percent compared with 2018, to 2.6 million metric tons. The table below shows January-September Chinese pork imports for 2018 and 2019. U.S. pork represented 10.5 percent of China’s imports during that period.”

Livestock, Dairy, and Poultry Outlook, LDP-M-305, U.S. Department of Agriculture, Economic Research Service, November 15, 2019.

The ERS Outlook added that, “Third-quarter U.S. pork exports were 1.516 billion pounds, 16.8 percent ahead of exports a year ago. Fourth-quarter exports are expected to be record-large at 2 billion pounds and largely reflect strong global demand for reduced supplies of animal proteins. Total pork exports this year will likely be just below 6.5 billion pounds, almost 11 percent above shipments last year. Exports next year—7.3 billion pounds—are expected to be supported by a continuation of largely similar factors that are currently driving global demand.”

Meanwhile, Reuters columnist Karen Braun pointed out on Friday that, “U.S. pork exports are seen setting another record in 2020, but production is predicted to do the same, and the numbers do not suggest a tightening in the domestic market given the projected demand. According to USDA, U.S. hog and pig inventory was record-high for the date back on Sept. 1, and 2020 pork production is seen rising 4% on the year to an all-time high of 13 million tonnes.”

Quarterly Hogs and Pigs. USDA, National Agricultural Statistics Service (September 2019).

In additional news regarding pork demand and China, Reuters writer Dominique Patton reported late last week that,

China’s pork imports in October doubled from a year earlier, as wholesalers stocked up on supplies after disease decimated the huge hog herd, customs data showed on Saturday.

“Pork imports for the first ten months of the year stood at 1.5 million tonnes, up 49.4% from the corresponding period a year earlier, data from the General Administration of Customs shows.”

The Reuters article stated that, “China has been opening up its market to new sources of meat, approving dozens of new pork processing plants in Brazil, Argentina and Britain in recent months to help alleviate its protein shortage.”

And with respect to beef protein, Reuters writer Roberto Samora reported last week that, “Brazil’s famous barbecue is getting more expensive as Chinese demand is increasingly swallowing up the country’s beef supply, pushing Brazilian cattle prices to a record high.

“China’s hunger for foreign meat has shot up as an outbreak of African swine fever has decimated its domestic pig population and has sent it looking for substitutes. Chinese imports of Brazilian meat are up 23.6% for January to October against the same period last year, meatpackers association Abrafrigo says.”

Bloomberg writer Tatiana Freitas pointed out last week that, “While China has been increasing local poultry production and raising pork imports from several suppliers, Brazil is the only big beef exporter able to meet the Asian nation’s demand. Chinese importers are snapping up all types of cuts, inflating prices along the Brazilian chain from calves to animals ready for slaughter.”

“Brazil Is the Big Beef Winner From China’s Hunt for Protein,” by Tatiana Freitas. Bloomberg News (November 21, 2019).

Also late last week, Bloomberg writer Megan Durisin reported that, “The deadly swine disease roiling China’s hog farms is getting closer to one of its top overseas suppliers of pork.

“African swine fever was found in 20 wild boar in Poland’s western Lubusz province this month, putting the disease within 80 kilometers (50 miles) of Germany, the European Union’s biggest hog producer. While eastern Europe has grappled with the virus for several years, the latest cases show Germany is ‘increasingly exposed’ to a potential spread, the agriculture ministry said.”

“Deadly Hog Virus Nears One of China’s Top Pork Suppliers,” by Megan Durisin. Bloomberg News (November 21, 2019).

And Wall Street Journal writer Liyan Qi reported on Friday that, “China said it hopes to restore most of its pork supply in roughly a year, as worries about African swine fever continue to hurt the industry.

“The number of breeding sows edged up 0.6% in October from a month earlier, rising for the first time since April last year, Yang Zhenhai, an official with China’s Agriculture and Rural Affairs Ministry, said at a briefing Friday.”

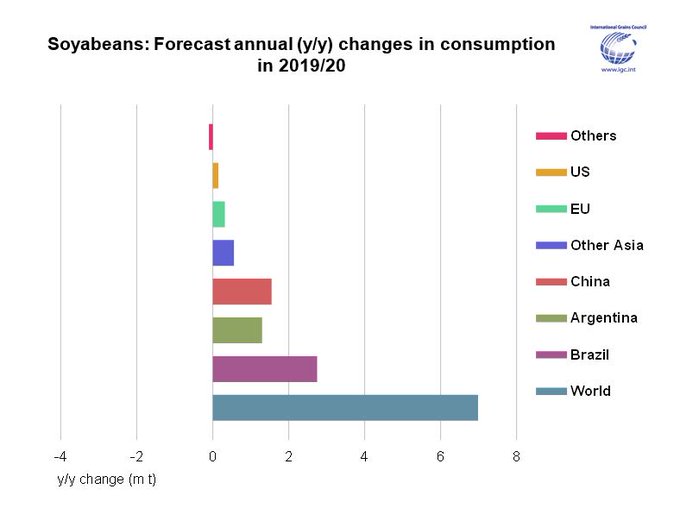

International Grains Council@IGCgrains

Global #soybean consumption is seen reaching a new peak in 2019/20, although the y/y increase will be below trend amid a slowdown in feed demand due to the impact of African Swine Fever in China.

The Journal article noted that, “The government aims to restore supply to about 80% of the level before African swine fever hit China by the end of next year, Mr. Yang said.”

Source: Keith Good, Farm Policy News