China’s Corn Imports Estimated to Hit 22 Million Metric Tons, USDA- FAS

A report earlier this month from USDA’s Foreign Agricultural Service (FAS), “China’s Corn Imports Estimated to Hit 22 Million Metric Tons,” stated that, “The forecast for China’s corn imports for MY 2020/2021 is increased from 7 MMT to 22 MMT. The jump is attributed to depleted stocks to meet current demand. Continually rising domestic corn prices will also drive demand for additional imports in MY 20/21.”

The FAS update explained that, “China’s Ministry of Agriculture and Rural Affairs (MARA)’s October China Agricultural Supply and Demand Estimates (CASDE) indicated the country has had a corn supply gap for the last several years which has been met with auctions from reserves. From May to September this year, MARA already auctioned off 57 MMT of reserves. The final auction was held September 13 with no further auctions planned until Spring. With tight reserves, sources indicate that substantial corn imports will be necessary to meet demand while also controlling further price increases and maintain stocks throughout 2021. Already in 2020, China has used temporary reserves of wheat and rice and imports of feed quality wheat in substitution for high priced, domestic corn.

As of October 22, China has contracted for over 10 MMT of U.S. corn for delivery in MY 20/21, with only about 2.0 MMT shipped to date. In addition, Ukraine, after making significant exports to China in 2019/20, has the potential to meet a sizable share of Chinese demand in the coming months.

The report added that, “Several sources report that the WTO 7.2 MMT corn TRQ has already been filled for CY 2020, and that China has quietly issued an additional 5 MMT TRQ to be used through December. Beyond the WTO corn quota, credible sources have substantiated that Chinese industry, both State Owned Enterprises and the private sector, is recommending to Chinese decisionmakers to allocate significant additional TRQ for CY 2021.”

Meanwhile, Bloomberg writer Alfred Cang reported last week that, “Millions of hungry pigs in China are setting off a chain reaction in the fuel market, causing the biggest oil refiner to rethink its sales strategy.

“A hog herd boom amid a push to revive supplies of the nation’s favorite meat has driven up corn prices as demand for animal feed soars. That’s sent biofuel costs flying for oil titan Sinopec Group, which is now being forced to scale back its plans to sell E10, a mix of 10% corn-derived ethanol and gasoline.”

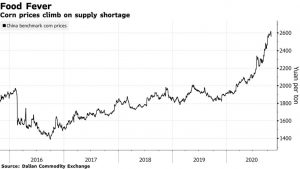

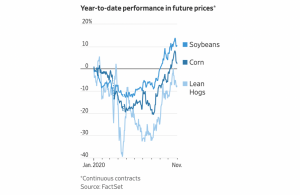

The Bloomberg article noted that, “Corn prices have jumped more than 30% this year in China as hog herds recovered more quickly than expected from African swine fever, demand increased from the starch industry and typhoons flattened the crop.”

With respect to Chinese soybean demand, a recent FAS report, “China: Oilseeds and Products Update,” indicated that, “China’s soybean imports are forecast to fall to 95 million metric tons (MMT) in marketing year (MY) 20/21 due to excessive beginning stocks following a buying spree in MY19/20. Driven by concerns about COVID-related supply disruptions and an uncertain bilateral relationship with the United States, China imported an estimated 98.5 MMT in MY19/20—a record high. Although feed production and soybean crush are projected to continue growing in MY20/21 to meet demand from the recovering swine herd and growing poultry sector, the beginning of a gradual drawdown in stocks is expected to constrain imports in MY20/21.”

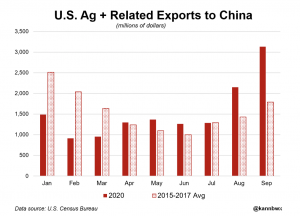

More broadly, Wall Street Journal writer Jacob Bunge reported last week that, “Rising agricultural exports to China are helping revive the fortunes of some agribusiness companies and farmers, after the coronavirus pandemic upended the U.S. farm sector.”

The Journal article stated that, “U.S. pork exports to China over the first eight months of 2020 totaled more than $1.5 billion, representing a record, according to U.S. Department of Agriculture data. China’s purchased or contracted sales of corn are at an all-time high of 8.7 million tons, the USDA and the Office of the U.S. Trade Representative said in an October report, and U.S. soybean sales to China have surged since early August.”

“Farm commodity sales to China are increasing as demand grows generally for food ingredients and animal feed, agriculture industry executives said, while dry weather has slowed planting in Brazil and raised concerns about the eventual size of that country’s harvest,” the Journal article said.

Source: Keith Good, Farm Policy News