China-High Demand for Farm Commodities Expected, as Food Inflation and Security Jitters Persist

Reuters writer Karl Plume reported last week that, “Chinese state-owned firms bought at least eight bulk shipments of U.S. soybeans on Wednesday, or at least 480,000 tonnes, for shipment in December and January, two U.S. traders familiar with the deals said.

“The bulk of the sales were for shipment from Pacific Northwest ports, with the remainder due to ship from U.S. Gulf Coast terminals, they said.

“The deals were the latest in a string of large farm commodity purchases by China, which vowed to import record amounts of U.S. agricultural goods this year as part of a ‘Phase 1’ trade deal signed in January.

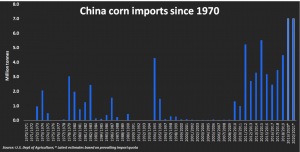

After months of record soybean imports from Brazil, China has pivoted to buying more soybeans and other goods from the United States. The world’s top commodity importer has already bought record volumes of U.S. corn, pork and poultry this year, and last month booked its largest-ever weekly purchase of U.S. beef.

Mr. Plume noted that, “Traders are expecting the robust demand to continue amid food security jitters in China, where food inflation has jumped to the highest in more than a decade.”

With respect to food security issues in China, Financial Times writer Christian Shepherd reported last week that, “Last month, President Xi Jinping launched an initiative dubbed ‘operation empty plates’ to safeguard China’s food security.

“The timing of the high-profile campaign has stoked lively discussions about food shortages. The debate intensified after a report from the state-backed Chinese Academy of Social Sciences projected a potential food shortfall of 130m tonnes by 2025.

“Fears have worsened since the coronavirus pandemic, devastating floods and deepening tensions with the US.”

The FT article explained that, “China’s agricultural ministry has sought to defuse anxiety by declaring ‘total confidence’ in its ability to ensure grain supply, noting that the country produces more than 95 per cent of the grains it needs.

Despite plentiful rice, corn and wheat, China remains dependent on imported soyabeans and is facing a pork shortage. Both issues are of acute concern for a president who preaches the need for self-sufficiency.

In addition, Reuters writers Hallie Gu and Dominique Patton reported last week that, “Soaring corn prices are stoking food security jitters in China, where food inflation has climbed to the highest in over a decade and President Xi Jinping made a recent high-profile plea for an end to wastage.

“The price surge in corn – critical for China’s mammoth hog, dairy and poultry sectors – is the latest in a series of ructions that include a devastating pig disease, pandemic-driven upsets for international suppliers and warnings of a growing food supply gap.

“Prices have risen as the country heads for its first real corn shortfall in years in the upcoming 2020/21 season starting in October and could face a deficit of up to 30 million tonnes, around 10% of its total crop, say analysts and traders.”

The Reuters article added that, “That would be a likely boon for major exporters like the United States and Ukraine, but threatens to push up global prices and have a knock-on impact elsewhere as some corn users switch to other grains.”

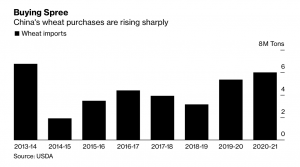

Also last week, Bloomberg writer Anatoly Medetsky reported that, “China’s [wheat] imports are expected to climb to a seven-year high this season — almost doubling in just two years — as the country tries to secure food supplies amid a recovery in the domestic economy following coronavirus lockdowns.”

Meanwhile, in a column on Saturday, Pat Westhoff, the director of the Food and Agricultural Policy Research Institute at the University of Missouri, stated that, “The ‘Phase 1’ deal was intended to result in more exports of U.S. farm commodities to China. When people look at the deal midway through the first year of implementation, some see a glass half empty and some see a glass half full.

“The negative case is easy to make. The deal was supposed to result in a significant increase in U.S. exports of agricultural products relative to a 2017 base period. Instead, for the first six months of 2020, U.S. agricultural exports to China were well below exports during the first six months of 2017.”

Dr. Westhoff noted that, “It is also possible to make a more positive case. Even if the targets are not met, China is increasing its purchases of U.S. products relative to the depressed levels of 2018 and 2019. Recently announced sales contributed to market rallies for both corn and soybeans.

“The more optimistic view would also point to policy changes China has made that could be beneficial to U.S. agriculture. China is no longer collecting the retaliatory tariffs placed on many U.S. farm goods because of the trade dispute. China now appears likely to meet a commitment to import at least 7 million metric tons of corn each year, and some barriers to U.S. meat exports have been removed.

“Another positive development is a significant increase in China’s imports of soybeans. Soybeans typically account for more than half of U.S. agricultural exports to China, and the main use of those imports is to make soybean meal for livestock feed.”

Dr. Westhoff added that, “Mathematically, there are two ways to increase U.S. exports to China. One is to increase the U.S. share of total imports by China. The other is to increase total imports by China. If the U.S. trade share increases simply by rearranging who trades with whom, the net benefit to U.S. soybean producers may be limited, but if the size of the pie increases, U.S. producers can benefit even when other exporters also continue to increase their sales.”

Source: Keith Good, Farm Policy News